If you’re an institutional investor, family office, or a high-net-worth individual looking to tap into the potential of later stage markets, Republic Capital is your gateway to lucrative opportunities. As a part of the Republic ecosystem, Republic Capital specializes in raising funds for later stage companies and has already made significant investments in well-known names like Carta, Robinhood, and Dapper Labs. What sets Republic Capital apart is its Republic Deal Room, which offers investors access to carefully selected deals with a minimum investment starting as low as $1,000. By investing in later stage deals, you can increase your chances of successful exits compared to seed rounds. With Republic, you now have a unique chance to gain access to later stage investments with smaller stakes, opening up a whole new world of possibilities for your portfolio.

About Republic Capital

Introduction to Republic Capital

Republic Capital is a specialized branch within the Republic ecosystem that works closely with institutional investors, family offices, and high-net-worth individuals to raise funds in later stage markets. With a focus on connecting investors with promising opportunities, Republic Capital offers unique access to high-growth companies and exclusive deals.

Role within the Republic ecosystem

As a key player in the Republic ecosystem, Republic Capital plays a crucial role in expanding investment options and facilitating connections between investors and entrepreneurs. By leveraging their expertise and vast network within the later stage markets, Republic Capital aims to provide investors with exclusive access to promising companies while helping entrepreneurs secure the funding they need to grow and thrive.

Target Investors

Institutional investors

Republic Capital is well-positioned to cater to the needs of institutional investors, including venture capital firms, private equity funds, and corporate investors. With their deep understanding of later stage markets and extensive network, Republic Capital offers institutional investors a valuable opportunity to diversify their portfolios, gain exposure to high-growth companies, and potentially achieve attractive returns on investment.

Family offices

Family offices, which typically manage the wealth and investments of affluent families, can greatly benefit from the expertise and access to exclusive deals provided by Republic Capital. By collaborating closely with family offices, Republic Capital helps these investors effectively navigate the complexities of the later stage markets, identify lucrative opportunities, and build a robust investment portfolio tailored to their specific goals and risk appetite.

High-net-worth individuals

High-net-worth individuals, seeking to make strategic investments in later stage markets, can rely on Republic Capital to provide them with the necessary resources and connections. Republic Capital’s extensive experience and insights enable them to offer tailored investment solutions to high-net-worth individuals, ensuring they can capitalize on unique opportunities and achieve their financial objectives.

Investment Strategy

Focus on later stage markets

Republic Capital’s investment strategy revolves around focusing on later stage markets, where companies have already achieved a certain level of success and are poised for further growth. By targeting companies in these stages, Republic Capital aims to minimize risk and increase the potential for successful exits, providing investors with attractive returns.

Significant investments in companies like Carta, Robinhood, Dapper Labs

Republic Capital has a proven track record of making strategic investments in later stage companies. They have successfully backed companies such as Carta, a leading provider of equity management solutions, Robinhood, a popular commission-free trading platform, and Dapper Labs, the creator of high-profile blockchain games like CryptoKitties and NBA Top Shot. These investments demonstrate Republic Capital’s ability to identify and support companies with significant growth potential.

Republic Deal Room

Access to select deals

Through the Republic Deal Room, investors gain exclusive access to select deals in later stage markets. This platform serves as a gateway to a curated list of high-growth companies, allowing investors to review investment opportunities and make informed decisions. By being part of the Republic ecosystem, investors can tap into Republic Capital’s expertise and vetted deal flow, increasing their chances of success.

Minimum investment starting at $1,000

Republic Capital understands that investment opportunities should be accessible to a wide range of investors. With a minimum investment starting at just $1,000, Republic opens up the playing field, enabling investors to participate in later stage deals without requiring a significant capital commitment. This democratization of access aligns with Republic’s mission to democratize investing and provide opportunities to investors of all sizes.

Advantages of Investing in Later Stage Deals

Higher probabilities of successful exits

Investing in later stage deals offers distinct advantages, including higher probabilities of successful exits compared to seed round investments. By entering at a later stage, investors can potentially benefit from a more mature company with proven traction, an established customer base, and a clearer path to profitability. This reduced risk profile is appealing to investors seeking stable returns and minimizing the uncertainties associated with early-stage investments.

Comparison with seed round investments

While seed round investments can yield substantial returns, they also carry higher levels of risk due to the early-stage nature of the companies involved. Investing in later stage deals provides investors with the opportunity to assess a company’s track record, market position, and growth potential before making a decision. This increased visibility allows investors to make more informed investment decisions, potentially improving their chances of achieving favorable outcomes.

Unique Opportunity for Investors

Access to later stage investments with smaller stakes

One of the unique opportunities provided by Republic Capital is the ability for investors to gain access to later stage investments with smaller stakes. Traditionally, these opportunities have been reserved for larger institutional investors or high-net-worth individuals. However, Republic Capital aims to level the playing field by ensuring that smaller investors also have the chance to participate in high-growth opportunities and potentially benefit from attractive returns.

Increasing investment options for smaller investors

Republic Capital recognizes the importance of expanding investment options for smaller investors. By opening up access to later stage markets, Republic Capital enables individual investors to diversify their portfolios and gain exposure to promising companies that could have a significant impact on their overall investment strategy. This expanded investment landscape empowers smaller investors to make strategic decisions and potentially achieve their financial goals.

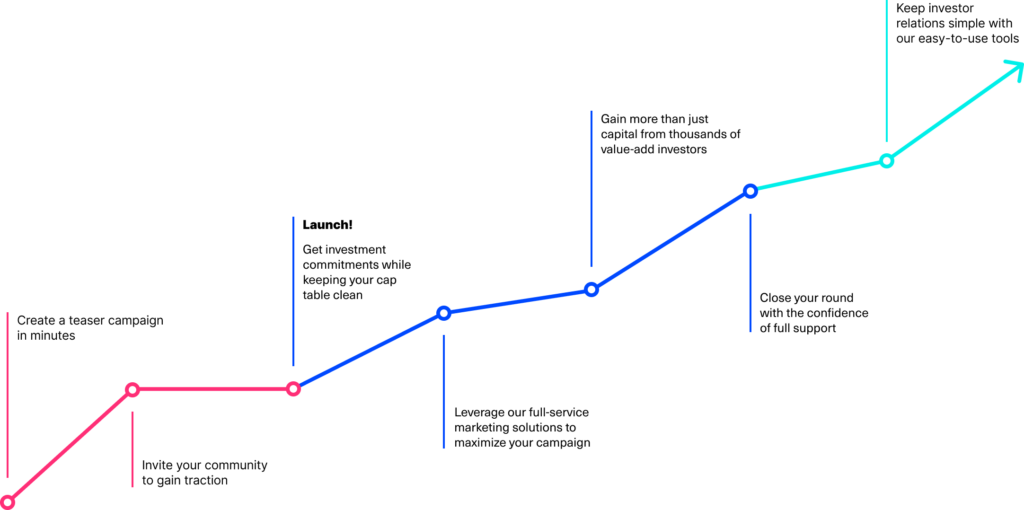

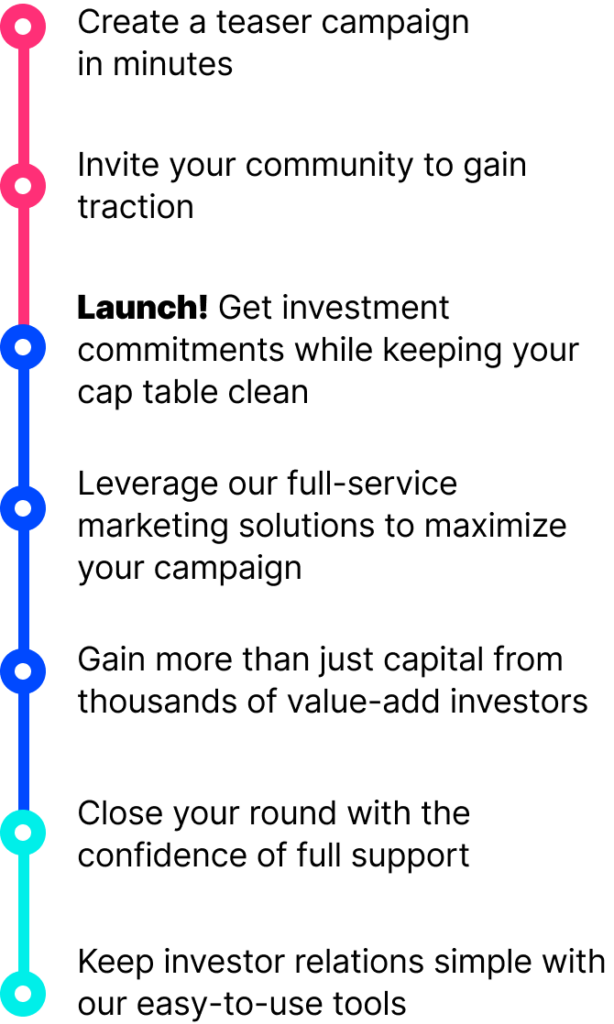

How Republic Capital Connects Investors to Later Stage Markets

Strategies for connecting investors and entrepreneurs

Republic Capital employs various strategies to effectively connect investors and entrepreneurs within later stage markets. Their experienced team leverages their extensive networks and industry knowledge to identify suitable investment opportunities that align with the specific requirements of investors. Through thorough due diligence and robust evaluation processes, Republic Capital ensures that only the most promising companies are presented to investors, streamlining the investment process and increasing the likelihood of successful outcomes.

Building a strong network within later stage markets

Republic Capital recognizes the importance of building a strong network within the later stage markets. By forging relationships with key players, including venture capitalists, entrepreneurs, industry experts, and thought leaders, Republic Capital enhances their ability to identify and access high-quality investment opportunities. This network-driven approach enables Republic Capital to provide their investors with unique and exclusive access to high-growth companies, further differentiating their offering in the market.

Benefits of Working with Republic Capital

Access to exclusive investment opportunities

By partnering with Republic Capital, investors gain access to exclusive investment opportunities that are not readily available in the general market. Republic Capital’s dedicated team of experts actively seeks out high-growth companies and vetted deals, ensuring that their investors have access to premium opportunities that have been thoroughly evaluated. This access to exclusive deals gives investors a competitive advantage and the potential for attractive returns on their investments.

Expertise in later stage markets

Republic Capital’s expertise in later stage markets sets them apart as a valuable partner for investors. With their deep knowledge and understanding of the intricacies of these markets, Republic Capital provides investors with valuable insights and guidance throughout the investment process. From due diligence to portfolio management, Republic Capital’s expertise helps investors navigate the complexities of later stage investments, maximizing their chances of success.

Key Considerations for Investors

Risk management in later stage investments

While later stage investments can offer attractive returns, it is crucial for investors to carefully assess and manage the associated risks. Republic Capital emphasizes the importance of conducting thorough due diligence and understanding the risk factors specific to each investment opportunity. By working closely with Republic Capital, investors can leverage their expertise in risk management and gain a deeper understanding of the potential risks involved, enabling them to make well-informed investment decisions.

Due diligence and evaluation of investment opportunities

Republic Capital places great importance on conducting rigorous due diligence and evaluating investment opportunities with a critical eye. Their team of experts thoroughly analyzes the financials, market potential, competitive landscape, and overall viability of each investment opportunity. Investor interests are the top priority for Republic Capital, and their commitment to due diligence ensures that investors have access to high-quality, vetted deals that align with their investment objectives.

Future Outlook

Expanding investment options

Looking ahead, Republic Capital aims to continue expanding investment options for their investors. By actively seeking out new opportunities, forging partnerships, and staying abreast of market trends, Republic Capital remains committed to providing their investors with diverse and lucrative investment options. They understand the evolving needs of investors and strive to meet those demands by identifying and offering cutting-edge investment opportunities in later stage markets.

Potential for growth within later stage markets

The future holds immense potential for growth within the later stage markets, making it an exciting area for investors to explore. Republic Capital is well-positioned to capitalize on these opportunities and help their investors navigate this landscape. As the demand for later stage investments continues to rise, Republic Capital remains at the forefront of facilitating connections between investors and entrepreneurs, ensuring that investors can take advantage of the growth potential offered by later stage markets.