In the dynamic world of African fintech, a new star is rising. Bujeti, an innovative corporate cards and spend management platform, has recently secured a substantial $2 million in seed funding. This impressive financial injection is set to catalyze Bujeti’s mission to redefine how African businesses, spanning from startups to large enterprises, handle their financial operations.

Empowering Businesses Across Diverse Sectors

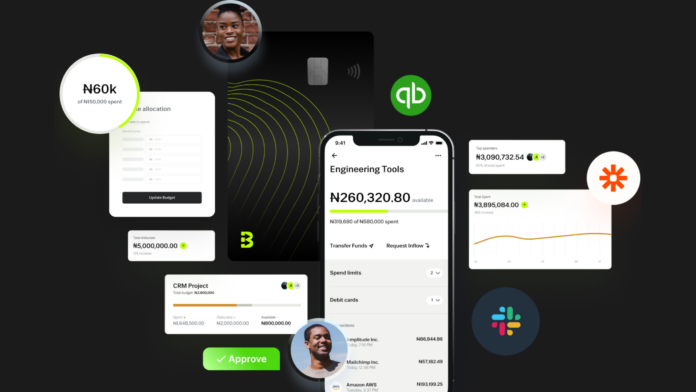

Bujeti’s unique platform caters to a variety of sectors, including healthcare, logistics, agriculture, and construction. The service simplifies financial management by issuing corporate cards to employees and contractors, ensuring a streamlined spending process. What sets Bujeti apart is its robust feature set. The platform provides critical financial controls such as setting spending limits, imposing restrictions, and establishing approval flows. These features empower businesses to manage expenses efficiently, ensuring financial discipline across all levels – from executives to vendors.

Accelerating Growth and Expanding Horizons

The recent funding marks a significant milestone for Bujeti. Not only does it promise accelerated growth and an expanded market presence, but it also paves the way for enhanced service offerings. The company has exciting plans on its roadmap, including the introduction of credit lines for small and medium-sized businesses (SMBs) and the development of bespoke products for larger enterprises.

The Founders’ Vision and Journey

The brains behind Bujeti, Founder and CEO Cossi Achille Arouko and COO Samy Chiba, launched this fintech gem in April 2022. Their journey is a testament to vision and determination. Arouko, with his rich experience at Paystack, and Chiba, with his background at Ariane Space, combined their expertise to create a solution initially envisioned for consumers. However, recognizing the untapped potential in the business sector, they pivoted Bujeti to focus on corporate clients, a decision that has clearly paid dividends.

Addressing a Crucial Market Need

Corporate card issuance, a common practice in regions like the U.S. and EU, faces unique challenges in Africa due to lower card penetration. Bujeti addresses this gap by enabling African companies to issue cards freely while maintaining rigorous control over spending. This solution is not just about financial control; it’s about empowering employees with spending freedom, underpinned by thoughtful policies and approval rules.

Rapid Adoption and Unique Market Position

Bujeti’s impact is already visible. Within eight weeks of its launch, it onboarded nearly 1,000 businesses, demonstrating the platform’s value proposition. Unlike its competitors, Bujeti isn’t just about expense management or corporate cards; it offers a comprehensive suite of features including superior automation and multi-entity management. This holistic approach allows for efficient oversight across different teams and geographies.

A Commitment to Continuous Innovation

As it stands, Bujeti is not resting on its laurels. The team is actively working on a multicurrency feature to enable businesses to pay staff in various countries. This forward-thinking approach positions Bujeti not just as a leader in African fintech but also as a potential global player.

Investor Confidence and Future Prospects

The faith of investors like Abdul Hassan, co-founder of Mono and OyaPay, in Bujeti’s vision is a strong endorsement of its potential. Hassan’s belief in the founders’ ability to transform business finance in Africa is a resounding vote of confidence. Bujeti’s journey is more than a story of financial success; it’s a narrative of innovation, empowerment, and the transformative power of fintech in emerging markets.