Being a good driver should pay!

BLUF:

Peace of mind is good, but money back is better.

No one enjoys paying for a product they don’t use. That’s especially true for car insurance – you pay year after year, but if you don’t have a wreck, what did you receive for the money you spent?

We need $3,023,000 to launch an auto insurance company that provides monetary reward for every insured driver – not just the ones that have accidents. Your investment of $10 (or any amount you want to contribute / invest) will establish a nationwide insurance company based in the Midwest that pays you 40% (average between $500 and $720) or more a year for a product (auto insurance) you are forced to purchase anyway.

Good driving should pay. Better Insurance provides exactly that solution . . . and more.

Campaign Summary

Better Insurance is a mutual insurance company that provides auto insurance for private and commercial automobiles and equipment.

Everyone knows the problem. If you drive your vehicle and never have a wreck, or had a wreck many years ago but nothing since, you have paid enough in car insurance payments to buy a new car. So where is your benefit if you don’t have accidents?

Being a good driver should pay – especially when bad drivers and insurance companies benefit, but not the people who drive well and avoid accidents. There is enough money generated in insurance to cover all the liabilities and perks, but insurance companies also spend money on a lot of overhead and costs that can be reduced or eliminated through better use of technology and process improvements.

Why crowdfund the startup costs? Being a public servant isn’t a path to great fortune. I am not rich after 15 years working for the Army and spending 12 years as a consultant, published author, and small business owner. My network isn’t full of millionaires looking for a new project to invest in, and crowdfunding enables those who will benefit most from insurance that rewards them to contribute to their own success and returns on investment.

This campaign will help fund the information technology infrastructure needed to support every customer, establish a functional operations center that helps process claims, support clients, promote sales, and manage the entire enterprise with efficiency and effectiveness.

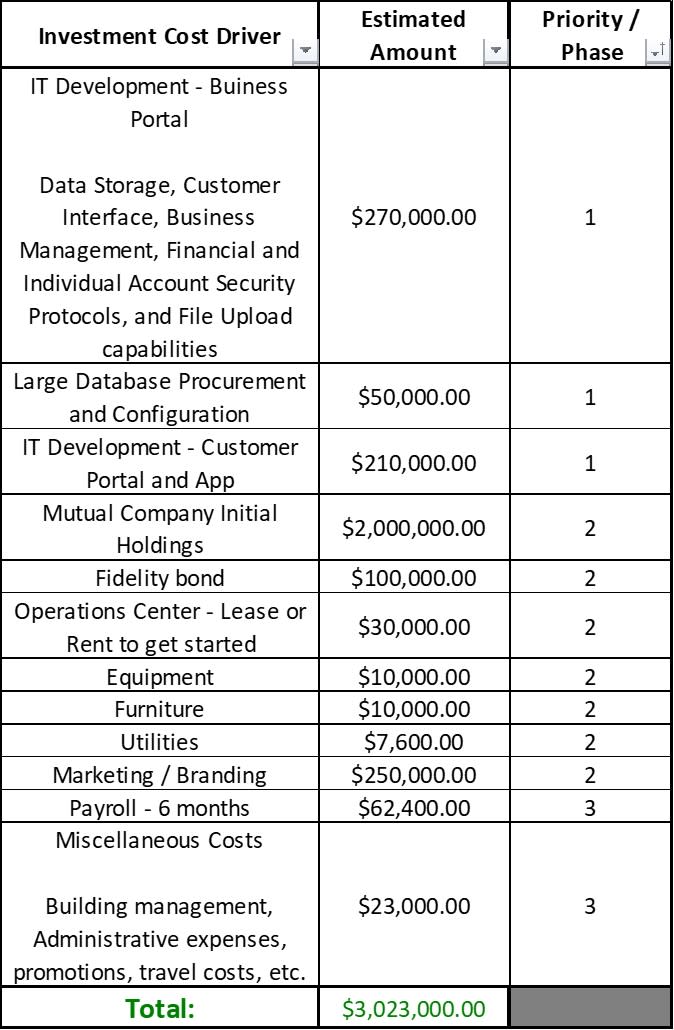

In addition, the largest part of the campaign funding goes to the liability coverage needed to establish a mutual company in the state of Indiana, which becomes the money used to pay back the investors once we reach 5,000 clients. The cost breakout is below.

We need your help to make auto insurance a business model that pays every client for the money they invest. This is a ground-breaking, game-changing effort that takes what works well in the insurance industry for covering your risks and liabilities, and improves that model by providing reward for not realizing those risks while covering those who have an accident. With Better Insurance, everyone wins because everyone receives benefit from paying for insurance that is required by all 50 states.

In simple terms, how would you like to receive 40% or more on what you pay in auto insurance back every year if you don’t have a claim or accident?

What We Need & What You Get

The breakdown of our startup costs: :

:

- This table shows the startup costs for the first 6 months (the IT contracts / licenses are for 2 years to ensure continuity and operational fluidity as we build our client base)

- Each investment of $10 from 302,300 people helps us cover those costs

- The fees for Indiegogo are an additional $151,150, which means the total number of $10 contributors should be 317,415

- There are two ways to contribute:

- As a future client with a donation of $10 (anything between $1 and $49 counts as a future client donation), which will be given back to you as a discount when you sign up with us, or,

- As an investor with a contribution of $50 or more which we will double upon return in this first 60 day campaign (If we go beyond 60 days, the return drops to 50%, and beyond 100 days, the return drops to 15% – the Think Long, Think Wrong process)

- This campaign will not stop until we have reached our goal. If we need to do a second campaign, we will cross that bridge when we get there. We believe that there are many people who are tired of insurance companies raising their prices, giving them nothing back, arguing over how much to pay when an accident occurs, and charging deductibles after already taking thousands of dollars year over year . . . we will succeed with the help of good people who want Better Insurance!

The Impact

Your contribution to this campaign enables us to launch a business model that should have been in place from the start for auto insurance. We’ve done it wrong for exactly 100 years now – starting in Massachusetts in 1925 with the first auto insurance company. Now it is time to fix what is wrong and ensure everyone receives benefit for a product they are forced to buy.

- Every driver must pay insurance to drive on the road. Because we are all forced to pay insurance, there should be benefit for everyone – not just those who have an accident. It is time to change the way auto insurance is done so that everyone benefits. In the Better Insurance model, we have streamlined processes, reduced operational overhead, capitalized on modern technology, and we don’t operate with greed or our profit as the success factor. 99% of all revenue generated goes directly to the client or in direct support of our clients.

- The owner is a Lean Six Sigma Black Belt that has led or participated in projects that have saved the taxpayer $2 billion and counting over the last 15 years. He has also identified and validated budget reductions and operational efficiencies for Army installations and Joint Bases to the tune of 10’s of millions. He was DOGE before DOGE was a thing, and now he is working for every one of you that pay car insurance every year and receive nothing in return other than so-called ‘peace of mind’. Big numbers and complex processes aren’t a challenge for him – the thrill of big improvements and making a difference every day are what drive him. Government isn’t the only arena that needs more efficiency – so does the private sector, including industries that have been run a certain way for decades but do not benefit the client adequately.

- Our rates are 10% or more below what you are currently paying for auto insurance, and we return 40% of what you pay every year that you don’t have a wreck or a major claim. All of this is guaranteed in contract upfront, including the rates you pay and the return you can expect each year. Example: For a baseline insurance payment of $100 a month, you would make $500 every year as a client refund if you don’t have a wreck (for the math wizards, we spot you the $20). A simple $10 contribution to this campaign makes that better business model happen for YOU . . . That’s Better Insurance!

Risks & Challenges

The only risk we have in offering this model of auto insurance is reaching the people that like paying a lot of money for nothing. If that is you, feel free to keep paying higher and ever-increasing insurance rates, deductibles, and payouts to investors while you receive nothing in return after paying $1,000’s of dollars every year because the state requires you to.

- Our premise for insurance is simple. The mission is to make the client whole when disaster strikes – what does it take to get there, facilitated by money brought in over time? Insurance is simply money management, using revenues generated to offset the impacts of risk realized. When you put your money into the clients instead of investments or clever commercials, you can avoid the pitfalls of not having enough to cover the risks when they occur.

- There are new insurance companies that claim they can insure you for $39-59 a month. What they don’t tell you is that when you pay for cheap insurance, you end up hiring a lawyer to pursue your claim because the company never intended to cover you fully. We baseline our rates starting at $50 and topping out around $900 a month for personal automobile insurance coverage, and we hold 40% of that money to return to you unless you have a wreck, in which case that year’s Client Refund is reverted to the Claims pool to cover your losses. We don’t invest it (no capital gains taxes or payouts to investors). We don’t misspend it. We don’t pay for a lot of buildings, people, utilities, or excessive advertising. You are our network, and we work to support you. We really don’t have competition, and the company you are with now will take at least 3-5 years (if ever) to catch up to this way of doing things because of the liabilities and obligations they have already incurred due to their bloated spending on everything but their clients. They certainly don’t have the ability to reward good drivers with 40% return on what you pay each year.

- We only expect to reach 1 of every 4 drivers, but that is more than enough. Perhaps standards aren’t important for you – we have a zero tolerance policy for DUIs, and we don’t really like drivers that are continuously at fault and causing wrecks. Perhaps money back in your pocket isn’t important to you – you are free to choose whatever company you want for your insurance needs. We will succeed because we don’t do gimmicks, shortcuts, or waste time arguing about what it takes to make the client whole when tragedy strikes. We’re here to help you – in good times and in bad.

Other Ways You Can Help

Some of you can’t contribute right now, but that doesn’t mean you can’t help:

- Go to our website (https://www.4betterdrivers.com) – Share that link with everyone you know!

- Use the Indiegogo share tools to share this campaign!

- Talk with your friends, family, co-workers, and the organizations you belong to – everyone who drives could use Better Insurance!

We look forward to serving and growing with you!