In “Demystifying IPOs: A Guide to Initial Public Offerings,” you will discover the intricacies of the IPO process and gain a clearer understanding of the benefits and risks that come with going public. This article serves as a comprehensive overview, taking you through the steps of an IPO, from preparation and planning to listing and trading. You will also learn about the advantages of going public, such as increased visibility and access to capital, as well as the potential challenges, including volatile stock prices and regulatory requirements. Additionally, the article emphasizes that an IPO is just the beginning of a new chapter for a company, highlighting the ongoing responsibilities and considerations that come with being a publicly-traded entity. Whether you are considering investing in a pre-IPO company or simply curious about the IPO process, this guide will provide you with valuable insights and knowledge.

The Basics of IPOs

Definition of an IPO

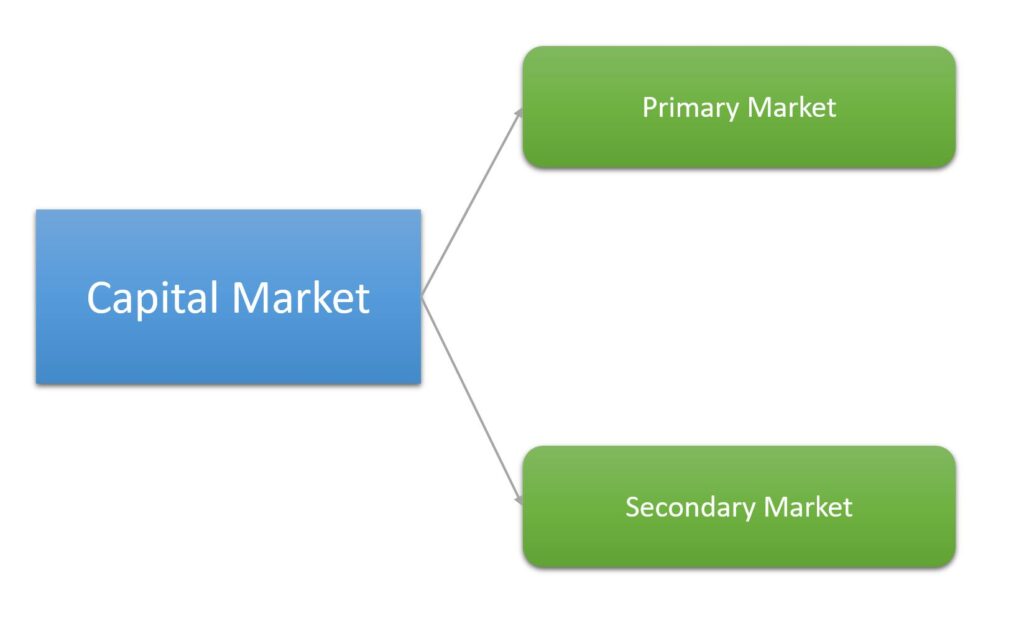

An Initial Public Offering (IPO) is a financial event where a privately-owned company goes public by offering shares of its stock on a stock exchange. This process allows the company to raise capital by selling ownership stakes to institutional and retail investors. The company becomes a publicly-traded entity, and its shares are available for purchase on the open market.

Process of Going Public

The process of going public involves thorough planning, due diligence, and regulatory compliance. The steps typically include evaluating readiness, engaging advisors, and filing a registration statement with the relevant regulatory authorities. Prior to the IPO, the company may conduct a roadshow to market itself to potential investors. The company, in coordination with investment banks, determines the IPO price and allocates shares to institutional investors. Once the IPO price is set, the shares are listed on a stock exchange, and trading begins.

Well-Known Stock Exchanges

Well-known stock exchanges where IPOs take place include the New York Stock Exchange (NYSE) and NASDAQ. These stock exchanges provide a platform for companies to list their shares and allow investors to buy and sell them on the open market. Listing on a reputable stock exchange can enhance a company’s visibility and credibility.

Preparing for an IPO

Evaluating Readiness

Before embarking on an IPO, a company needs to assess its readiness. This evaluation may involve financial audits, legal compliance checks, and refining the business strategy to meet the expectations of public investors. It is important to ensure that the company has a solid foundation and is prepared to meet the regulatory and reporting requirements that come with being a public company.

Engaging Advisors

The IPO process can be complex, so companies often engage the services of investment banks, legal counsel, and financial advisors. These professionals provide guidance and expertise throughout the IPO journey, helping the company navigate regulatory obligations, pricing decisions, and investor communication. Their experience can be invaluable in ensuring a smooth and successful transition to being a public company.

Filing the Registration Statement

Filing a registration statement with the relevant regulatory authorities, such as the U.S. Securities and Exchange Commission (SEC), is a crucial step in the IPO process. This statement provides a comprehensive overview of the company’s financials, business operations, risks, and other pertinent information. It is essential to ensure that the registration statement is accurate, complete, and compliant with regulatory requirements.

The Roadshow

Marketing to Potential Investors

Prior to the IPO, companies often embark on a roadshow to market themselves to potential investors. This involves presenting the investment opportunity to institutional investors and showcasing the company’s growth prospects and financial performance. The roadshow allows the company to build interest and generate excitement among potential investors.

Presenting Growth Prospects and Financial Performance

During the roadshow, company executives have the opportunity to present the company’s growth prospects and financial performance to potential investors. This includes discussing key metrics, such as revenue growth, profitability, and market share. The goal is to demonstrate the company’s potential for future success and attract investors who believe in its long-term prospects.

Determining IPO Price

Coordination with Investment Banks

Determining the IPO price involves coordination between the company and investment banks. Investment banks play a crucial role in underwriting the IPO, helping to assess the company’s value and market demand for its shares. They provide guidance on pricing decisions, taking into account factors such as the company’s financial performance, industry trends, and market conditions.

Reflecting Company Valuation and Market Demand

The IPO price reflects the company’s valuation and market demand for its shares. It is important to strike a balance between maximizing proceeds for the company and ensuring that the price is attractive to potential investors. Setting the right IPO price is crucial in generating interest and achieving a successful IPO.

Listing and Trading

Shares Listed on Stock Exchange

Once the IPO price is determined, the company’s shares are listed on a stock exchange. Listing on a stock exchange provides liquidity for the company’s shares, allowing investors to buy and sell them on the open market. This listing enhances the visibility and credibility of the company, as it becomes a part of the larger stock market ecosystem.

Subject to Market Forces and Investor Sentiment

After the shares are listed, their performance is subject to market forces and investor sentiment. The stock price can be influenced by factors such as market dynamics, economic conditions, industry trends, and investor perception of the company’s prospects. It is important for the company to stay informed about market developments and investor sentiment to navigate the post-IPO landscape effectively.

Benefits of Going Public

Increased Visibility and Brand Awareness

Going public can significantly increase a company’s visibility and brand awareness. Being a publicly-traded entity exposes the company to a wider pool of investors, customers, and the general public. This heightened profile can enhance brand recognition, attract potential customers, and build trust in the marketplace.

Access to Essential Capital

One of the primary benefits of going public is access to essential capital. By issuing shares to the public, companies can raise significant funds to fuel growth initiatives, research and development, expansion into new markets, and other strategic activities. This access to capital can be crucial in accelerating the company’s growth and achieving its long-term objectives.

Liquidity for Investors

Going public provides liquidity for existing shareholders, including founders, employees, and early investors. These stakeholders can monetize their investments by selling shares on the public market. Liquidity allows them to realize the value of their ownership stakes and potentially diversify their investment portfolios. It also creates an opportunity for new investors to enter the market and participate in the company’s growth.

Risks and Considerations

Volatile Valuation of Shares

Once a company goes public, the valuation of its shares can be subject to fluctuations. Stock prices can be influenced by market dynamics, economic conditions, industry trends, and investor sentiment. The volatility of share prices can impact the perceived value of the company and the returns for investors. It is important for investors to be aware of these fluctuations and consider them in their investment decisions.

Increased Regulatory Scrutiny

Public companies are subject to rigorous regulatory requirements and reporting obligations. Compliance with these regulations can be time-consuming, costly, and require ongoing monitoring and disclosure. The company must ensure that it maintains transparency and accountability to shareholders, regulators, and the general public. Failure to meet regulatory obligations can result in legal and reputational risks.

Dilution of Ownership

Issuing new shares to the public can dilute the ownership stake of existing shareholders, including founders and early investors. As the company raises capital through the IPO, new investors acquire ownership stakes, potentially reducing the percentage ownership of existing shareholders. It is important for shareholders to understand and evaluate the potential dilution effects before deciding to go public.

Costs and Complexity

The process of going public involves expenses, including legal, accounting, marketing, and underwriting fees. Additionally, the administrative burden of complying with regulatory requirements can be substantial. These costs and complexities should be carefully evaluated and factored into the decision-making process. It is important for companies to have a clear understanding of the financial implications associated with going public.

Loss of Control

Going public means opening up the company to a broader range of stakeholders, including shareholders, analysts, and regulatory bodies. As a publicly-traded entity, the company is accountable to these stakeholders, and decision-making may be subjected to additional scrutiny. This loss of control can result in a loss of operational flexibility and autonomy. It is crucial for founders and management to carefully consider and manage the potential impact on the company’s strategic direction.

Post-IPO Considerations

Stakeholder Accountability

As a public company, there is a heightened level of stakeholder accountability. Shareholders, analysts, regulators, and the media hold the company accountable for its performance and strategic decisions. Transparency and clear communication with stakeholders are important to maintain trust and confidence in the company’s management.

Continuous Communication

Public companies are required to communicate transparently with investors, analysts, and the media. This includes providing regular updates on financial performance, strategic direction, operational milestones, and any material events that may impact the company. Effective communication is key to building and maintaining investor confidence, as well as managing public perception.

Strategic Adaptation

Market conditions and investor preferences can change rapidly. Public companies need to remain adaptable and responsive to evolving trends and dynamics. This may involve continuously assessing and adjusting the company’s strategies, product offerings, and operational approach to stay competitive. Strategic adaptation is crucial for long-term success in the dynamic and ever-changing business landscape.

Conclusion

Going public through an IPO is a transformative step that requires careful planning, consideration of benefits and risks, and a clear understanding of the responsibilities that come with being a public company. While an IPO can provide access to essential capital and increase visibility, it also demands ongoing compliance, accountability, and strategic agility. Companies should weigh the benefits and risks before deciding on the best path to achieve their growth objectives. It is also important to note that there are alternatives to IPOs, such as mergers and acquisitions or staying private, which may be more appropriate for certain companies and their specific circumstances.