In the ever-evolving fintech landscape, Bilt Rewards just made a monumental leap, securing a whopping $200 million in fresh funding. This significant capital infusion has rocketed the company’s valuation to an impressive $3.1 billion. Spearheaded by General Catalyst, this investment round marks a notable upturn for the New York-based firm, more than doubling its valuation since its previous $150 million raise in October 2022.

But who’s behind this substantial investment? Leading the charge is General Catalyst, alongside contributions from Eldridge and existing supporters like Left Lane Capital, Camber Creek, and Prosus Ventures. This funding round isn’t just about the numbers; it’s about the confidence and vision these investors have in Bilt Rewards.

Adding to the strategic move, Ken Chenault, Chairman and Managing Director of General Catalyst and former Chairman and CEO of American Express, is set to join Bilt’s board of directors. And that’s not all – NFL Commissioner Roger Goodell is also coming on board as an independent director. These high-profile inclusions in Bilt’s leadership underline the company’s growing influence in the fintech space.

This financial milestone comes at a time when mega-rounds (investments over $100 million) are becoming increasingly rare. According to CB Insights’ State of Venture Report 2023, the frequency of such rounds has significantly decreased since their peak in 2021. This context makes Bilt’s achievement all the more remarkable, demonstrating its resilience and potential in a tightening investment environment.

Since its inception in June 2021, stemming from the startup studio Kairos led by founder and CEO Ankur Jain, Bilt has been on a rapid trajectory. With this latest round of funding, the company’s total capital raised stands at a formidable $413 million. The growth is not just in numbers; Bilt’s annualized member spend is nearing the $20 billion mark, and the company proudly reached EBITDA profitability in 2023.

What sets Bilt apart? Its unique platform allows consumers to earn rewards on rent payments and daily expenditures in their neighborhoods. This innovative approach has seen the company expand its loyalty program and payment platform to nearly 4 million apartment units, up from 2.5 million at the time of its last funding round.

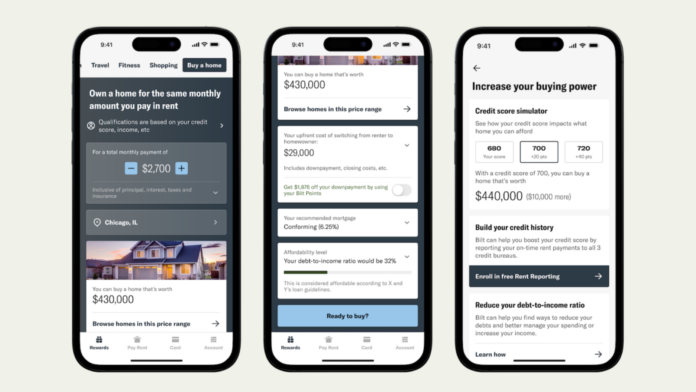

Bilt’s strategy is simple yet impactful: users earn points and build their credit score by paying rent. The versatility of Bilt’s points system is a key attraction, with points redeemable across various loyalty programs, including major airlines, hotels, and even Amazon.com purchases. Users can also convert points towards rent credits or future down payments.

Looking ahead, Bilt plans to channel the new capital towards expanding its Rewards Alliance, which collaborates with multifamily, single-family, and student housing operators nationwide. Additionally, the company aims to enhance its Neighborhood Rewards program, fostering stronger connections and loyalty between local merchants and residents. An exciting development on the horizon is the expansion into mortgage payment rewards.

Bilt’s offerings also include a co-branded Mastercard, issued by Wells Fargo, enabling rent payments without transaction fees while earning Bilt Points.

In conclusion, Bilt Rewards’ latest funding round isn’t just a financial triumph; it’s a testament to the company’s innovative approach to fintech and real estate. As Bilt continues to expand and evolve, it stands as a beacon in the fintech sector, showcasing how innovative solutions can transform everyday financial activities like paying rent into rewarding experiences. Stay tuned as Bilt Rewards continues to reshape the landscape of loyalty programs and consumer finance.