Causes of the 2008 Financial Crisis

Overexpansion of Credit in the Real Estate Market

One of the main causes of the 2008 financial crisis was the overexpansion of credit in the real estate market. Banks and lending institutions were providing mortgages to borrowers who did not meet the necessary criteria, resulting in a surge of home purchases. This led to an increase in demand for housing and caused prices to skyrocket. As a consequence, the market became saturated, and many homeowners were unable to repay their mortgages, ultimately leading to a collapse.

Burst of the US Housing Bubble

The overexpansion of credit in the real estate market resulted in the creation of a housing bubble. A housing bubble occurs when the prices of homes rise to unsustainable levels, driven by speculation rather than the actual value of the property. In the case of the 2008 crisis, the bubble eventually burst, causing a significant decline in home prices. Homeowners were left with properties that were worth significantly less than their mortgages, leading to widespread foreclosures and financial distress.

Worthlessness of Mortgage-Backed Securities

Mortgage-backed securities played a crucial role in the 2008 financial crisis. These securities, which were initially sold as investments, were backed by bundles of mortgages. However, as more and more homeowners defaulted on their mortgages, the value of these securities plummeted. Investors who had purchased these securities suffered significant losses, contributing to the panic and lack of confidence in the financial system.

Panic and Bankruptcies

The collapse of mortgage-backed securities and the subsequent decline in home prices caused panic among investors and financial institutions. Banks and other financial entities had invested heavily in these securities, and the sudden devaluation of their assets resulted in significant losses. As a result, many institutions were on the brink of bankruptcy. This further instilled a lack of trust in the financial system, leading to a widespread freeze in lending and a severe economic downturn.

Lessons Learned from the 2008 Crisis

Improved Risk Management

One of the most important lessons learned from the 2008 crisis was the need for improved risk management in the financial sector. Banks and other institutions realized the importance of accurately assessing and managing risks associated with their lending practices. This involved implementing stricter criteria for loan approvals, conducting thorough due diligence on borrowers, and implementing robust risk assessment models.

Transparency

The lack of transparency surrounding the mortgage-backed securities market was a significant contributing factor to the 2008 crisis. Investors were not fully aware of the underlying risks associated with these securities, leading to substantial losses. As a result, the importance of transparency became evident, and regulators and financial institutions aimed to provide clearer information about the risks and characteristics of financial products.

Regulatory Oversight

The 2008 crisis exposed shortcomings in regulatory oversight of the financial industry. Regulatory authorities were criticized for being too lenient and failing to address emerging risks adequately. In response to this, regulators implemented stricter regulations and enhanced their oversight powers. The goal was to prevent excessive risk-taking, ensure the stability of the financial system, and protect consumers.

Changes Implemented after the 2008 Crisis

Improved Lending Standards

One of the significant changes implemented after the 2008 crisis was the enhancement of lending standards. Banks and lending institutions revised their loan approval processes to reduce the likelihood of lending to borrowers who could not afford the loans they were taking on. This involved thorough income verification, stricter debt-to-income ratio requirements, and more conservative loan-to-value ratios. The aim was to prevent the overextension of credit and reduce the risk of default.

Tighter Financial Regulations

To address the regulatory gaps exposed during the 2008 crisis, tighter financial regulations were implemented. These regulations aim to enhance the stability and soundness of the financial system by imposing stricter capital requirements on banks, enhancing regulatory oversight and enforcement, and limiting the risk-taking behaviors of financial institutions. The goal is to prevent excessive risk accumulation and ensure that banks and other financial entities are better positioned to withstand economic downturns.

Comparing the Collapse of US Banks in 2023 to the 2008 Financial Crisis

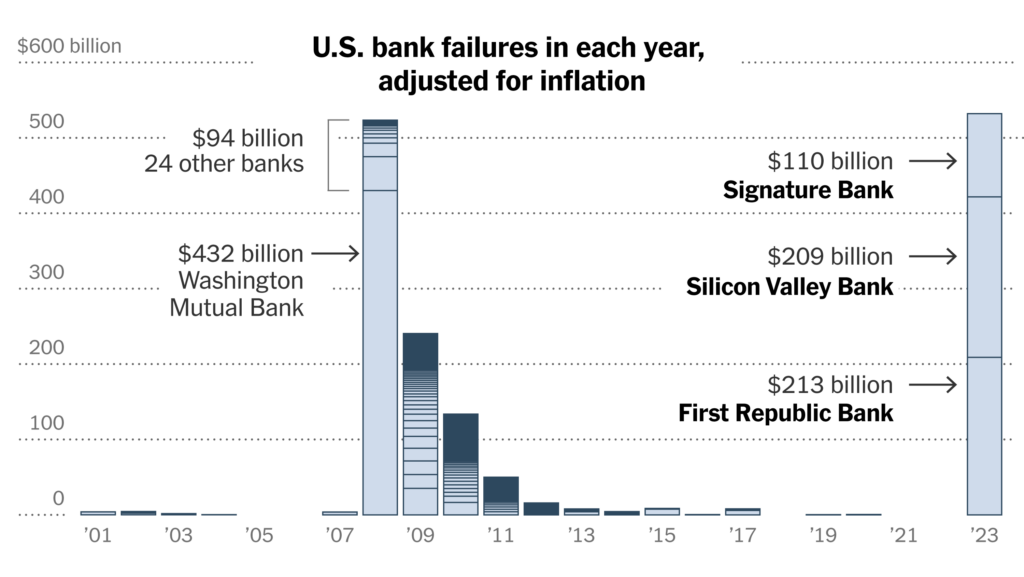

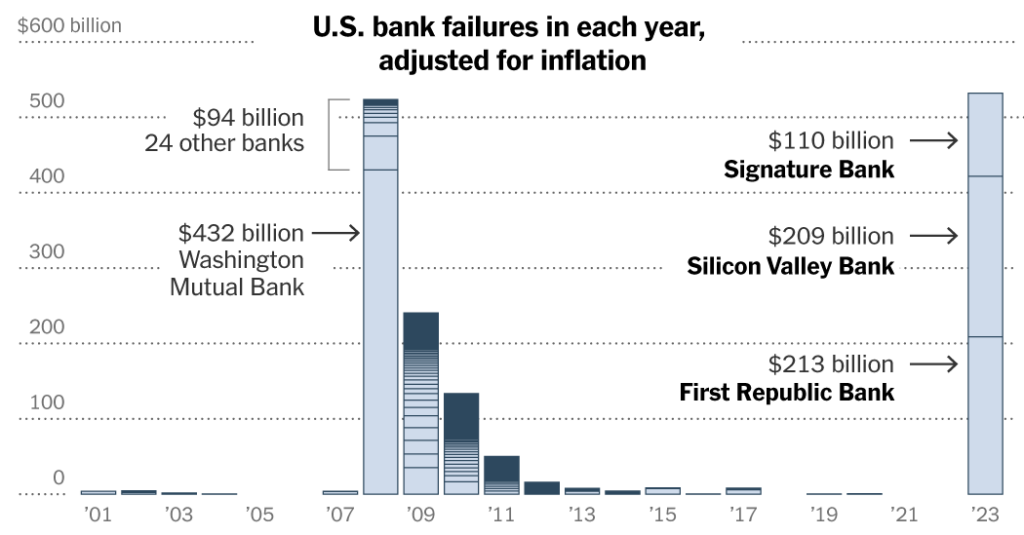

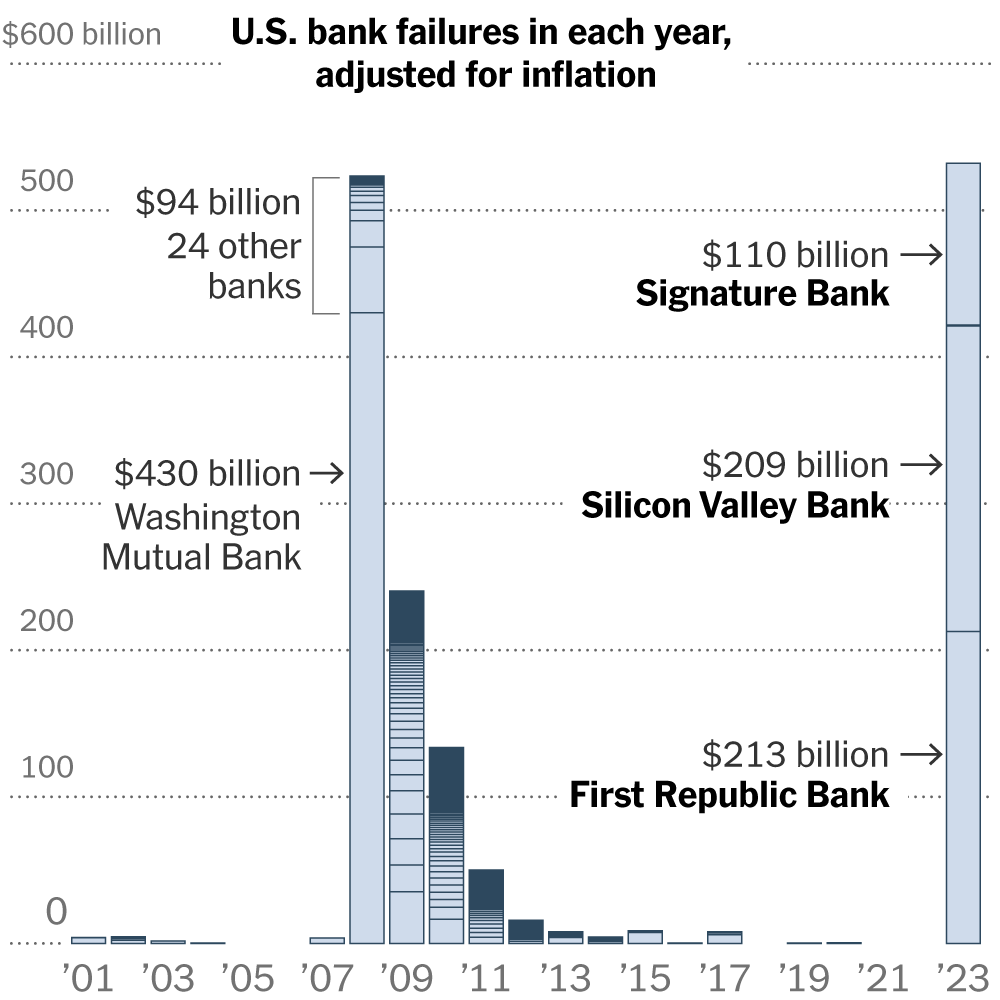

Extent of the Collapse

The collapse of US banks earlier this year prompted comparisons to the 2008 financial crisis. However, it is crucial to note that the extent of the collapse in 2023 was significantly smaller compared to the 2008 crisis. While some banks did face financial struggles and required government intervention, the overall impact on the financial system was relatively contained.

Triggering Factors

The triggering factors of the collapse in 2023 were also distinct from those of the 2008 crisis. The 2008 crisis was primarily caused by an overexpansion of credit in the real estate market. In contrast, the collapse in 2023 was largely driven by a combination of external factors such as global economic uncertainty, geopolitical tensions, and the impact of the COVID-19 pandemic.

Effect on Mortgage-Backed Securities

Unlike in 2008, the collapse in 2023 did not result in mortgage-backed securities becoming worthless. While there was certainly some devaluation of these securities, it was not on the same scale as what was seen during the 2008 crisis. This can be attributed to the improved lending standards and tighter financial regulations implemented after the 2008 crisis, which helped to mitigate some of the risks associated with these securities.

Level of Panic and Bankruptcies

The level of panic and bankruptcies during the collapse of US banks in 2023 was relatively lower than what was experienced in 2008. This can be attributed to the lessons learned and changes implemented after the previous crisis. The improved risk management practices, transparency, and regulatory oversight helped to instill a greater sense of confidence in the financial system, reducing the likelihood of a widespread panic and a large number of bankruptcies.

Current Status of US Housing Market

Contained Nature of Recent Bank Struggles

The recent struggles of US banks appear to be contained and not indicative of an imminent collapse in the US housing market. While some banks faced financial difficulties due to a combination of economic factors, efforts were made to prevent the situation from spiraling out of control. Government intervention, regulatory oversight, and swift action by financial institutions helped to mitigate the risks and prevent a systemic crisis.

Resilience of the US Housing Market

The US housing market has shown resilience in the face of recent challenges. Despite the struggles faced by banks and the economic uncertainties, the housing market has remained relatively stable. Home prices have not experienced a significant decline, and demand for housing remains strong. This resilience can be attributed to the improved lending standards, tighter financial regulations, and the overall strength of the US economy.

Positive Indicators for the US Housing Market

There are several positive indicators for the US housing market, suggesting a positive outlook moving forward. Mortgage rates remain historically low, making homeownership more affordable for many individuals. Additionally, housing supply has not exceeded demand, creating a market that is relatively balanced. These factors, combined with the economic recovery, provide a favorable environment for the US housing market to continue its growth.

Regulatory Measures and Risk Reduction

Tighter Regulations

Tighter regulations have been instrumental in reducing the risks associated with the US housing market. Stricter lending standards and enhanced regulatory oversight have helped to prevent the overextension of credit and limit the accumulation of risky mortgages. This has led to a more stable housing market, with fewer borrowers taking on mortgages they cannot afford.

Fewer Adjustable-Rate Mortgages

Another significant change implemented after the 2008 crisis was a reduction in the number of adjustable-rate mortgages (ARMs) being offered. ARMs played a significant role in the 2008 crisis, as many borrowers were unable to cope with rising interest rates. By limiting the availability of ARMs, the risk of a sudden surge in mortgage payments and subsequent defaults has been minimized, contributing to a more stable housing market.

Reduced Risk of a Housing Bubble

The combination of tighter regulations and improved risk management practices has significantly reduced the risk of a housing bubble in the US. Lending institutions are now more cautious in their lending practices, ensuring that borrowers have the ability to repay their mortgages. This helps to prevent the artificial inflation of housing prices and the subsequent collapse that can occur when the bubble bursts.

Remaining Risks in the US Housing Market

Inherent Risks

While significant progress has been made in reducing risks, there are still inherent risks in the US housing market. Economic downturns, job losses, and changes in interest rates can all impact homeowners’ ability to meet their mortgage obligations. Additionally, unforeseen events such as natural disasters can cause property values to decline rapidly. These factors highlight the importance of continued vigilance and risk management in the housing market.

External Factors

External factors, such as global economic conditions and geopolitical tensions, can also pose risks to the US housing market. Economic instability or a decline in investor confidence can impact the overall economy and, consequently, the housing market. Changes in government policies, including regulations and tax incentives, can also influence housing demand and prices. These external factors require ongoing monitoring and adaptation to mitigate potential risks.

Market Volatility

Volatility in financial markets can have an impact on the US housing market as well. Sharp fluctuations in stock prices, currency values, and interest rates can create uncertainties for potential homebuyers and investors. This can lead to a slowdown in activity in the housing market, affecting both prices and demand. Proper risk management and contingency planning are necessary to mitigate the effects of market volatility on the housing market.

The Role of Risk Management and Transparency

Importance of Risk Management in Banks

The 2008 crisis highlighted the crucial role of risk management in the banking sector. Banks and other financial institutions play a significant role in the US housing market, as they provide the financing necessary for individuals to purchase homes. Effective risk management practices help to ensure that loans are granted to borrowers who can repay them, reducing the likelihood of defaults and the associated risks to the financial system.

Measures to Ensure Transparency

Transparency is essential in maintaining the stability and trust in the US housing market. Lenders and financial institutions should provide clear information about the terms and conditions of loans, including interest rates, fees, and potential risks. Similarly, investors in mortgage-backed securities should have access to accurate and transparent information about the underlying mortgages and associated risks. This allows market participants to make informed decisions and contribute to a more stable housing market.

Regulatory Oversight and Enforcement

Regulatory oversight and enforcement are crucial in fostering risk management and transparency in the housing market. Regulatory authorities play a critical role in setting and enforcing lending standards, monitoring financial institutions’ activities, and addressing any misconduct or violations. Strong and effective regulatory oversight helps to ensure that the necessary risk mitigation measures are in place, reducing the likelihood of another housing market collapse.

Implications for the Future of US Banking

Lessons to Be Applied

The 2008 crisis provided valuable lessons that can be applied to the future of US banking. The importance of risk management, transparency, and regulatory oversight cannot be overstated. Banks and other financial institutions must continue to prioritize these aspects to maintain a stable and resilient banking sector. This involves implementing robust risk management frameworks, enhancing transparency in financial products, and ensuring compliance with regulatory requirements.

Balance of Risk and Growth

The future of US banking requires a balance between risk and growth. Banks need to find a balance between providing access to credit and managing the associated risks. This involves careful assessment of borrowers’ creditworthiness, ensuring adequate collateral, and monitoring and managing risks throughout the loan lifecycle. Striking a balance between risk and growth is necessary to maintain a healthy and sustainable banking sector.

Continued Improvement in Financial Regulations

Financial regulations must continue to adapt and evolve to address emerging risks in the banking sector. The 2008 crisis exposed weaknesses in the regulatory framework, and subsequent changes were implemented to mitigate these risks. However, as the financial landscape evolves, new risks may emerge. Continual evaluation and improvement of financial regulations are necessary to maintain the stability and integrity of the US banking system.

Conclusion

While the collapse of US banks earlier this year prompted comparisons to the 2008 financial crisis, the two events exhibit significant differences. The 2008 crisis was characterized by an overexpansion of credit in the real estate market, a burst of the US housing bubble, worthlessness of mortgage-backed securities, and widespread panic and bankruptcies. The lessons learned from this crisis resulted in improved risk management, transparency, and regulatory oversight, as well as changes in lending standards and financial regulations.

The recent struggles of US banks in 2023, while concerning, were contained and did not pose the same level of risk to the US housing market as the 2008 crisis. The US housing market has shown resilience, with positive indicators suggesting a bright future ahead. Regulatory measures have helped reduce risks in the housing market, and ongoing risk management and transparency will continue to be crucial.

Moving forward, the future of US banking requires a balance between risk and growth, with continued improvement in financial regulations. The lessons learned from the 2008 crisis provide a guide for navigating future challenges. With focused efforts on risk management, transparency, and regulatory oversight, the US banking sector can maintain stability and contribute to the overall health and prosperity of the US housing market.