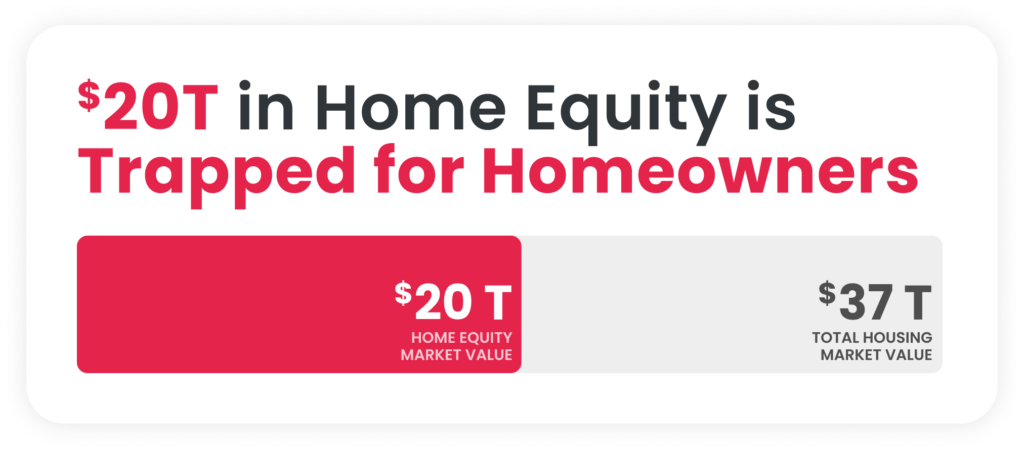

Nada is a wealthtech platform that aims to unlock the $20T home equity market for homeowners and investors. With rising interest rates and inflation levels, homeowners face significant challenges in maintaining their financial stability and security. However, a majority of American family wealth, approximately 68%, is trapped in home equity. The current financial system makes this equity inaccessible, leaving homeowners with limited options to access their wealth. Nada is addressing this problem by providing homeowners with innovative solutions to cash out their home equity without adding new debt or monthly payments.

The State of the Home Equity Market

Challenges for Homeowners

Historically, homeowners have had limited options to access their home equity. They could either sell their home and move out or take on the burden of extra debt through refinancing or home equity loans. These options were not ideal for homeowners looking to maintain their largest asset and financial stability. With rising interest rates and inflation, homeowners face even greater challenges in finding ways to access their home equity and ensure their financial security.

The Inaccessibility of Home Equity

The current financial system poses a significant barrier to homeowners in accessing their home equity. Many people are locked out of the economic benefits of owning residential real estate due to high housing costs. Public real estate investment trusts (REITs) are correlated with the volatility of the stock market, making them less accessible to the average investor. Private real estate investing is often exclusive to the wealthy and difficult to access. There is a lack of real estate investment products that provide investors with access to the $20T home equity sector.

The Need for a Level Playing Field

There is a need to level the playing field in real estate ownership and provide opportunities for families to stay in their homes rather than selling to institutions. Nada recognizes the importance of creating a product that allows families to access their wealth while maintaining ownership of their homes. By addressing the barriers to entry in the home equity market, Nada aims to create equal opportunities for homeowners and investors alike.

Nada’s Solutions

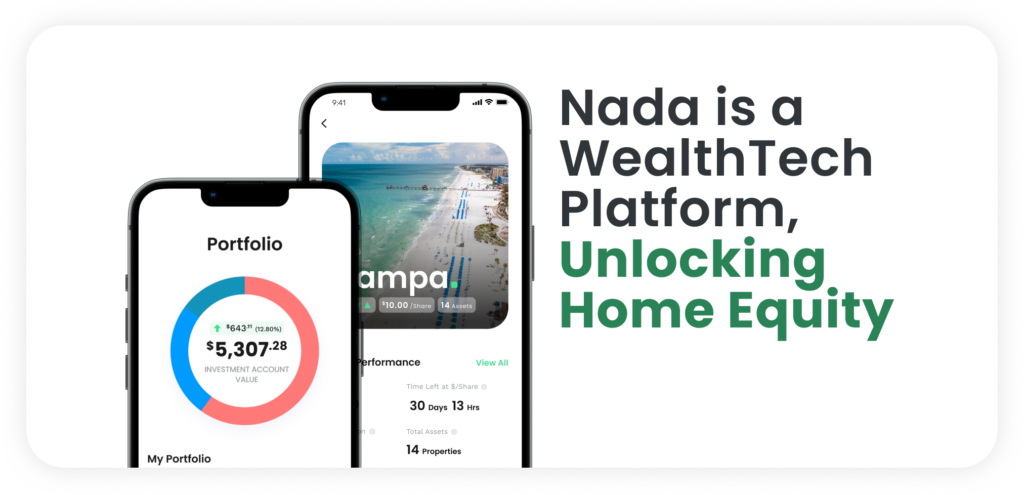

Nada offers two innovative products to unlock the home equity market: Homeshares and Cityfunds. These products provide homeowners with a way to cash out their home equity without adding debt and offer investors access to the $20T home equity market.

Homeshares: Unlocking Home Equity

Homeshares is Nada’s solution for homeowners looking to cash out their home equity. Traditional options, such as selling the home or taking on additional debt, come with their drawbacks. Nada’s Homeshares product allows homeowners to collect their equity in cash without adding the burden of new debt or monthly payments. The process is simple and transparent, and homeowners can receive their funds in just two weeks. In exchange for the upfront cash, Nada is granted a lien-secured interest in the home’s future value. As the home appreciates in value, Nada’s co-investment also realizes returns. Nada sells these Homeshares to Cityfunds, enabling investors to tap into the equity upside of homes in the nation’s top real estate markets.

Cityfunds: A New Way to Own Residential Real Estate

Inspired by thematic ETFs in the equities market, Nada created Cityfunds to provide investors with a new way to own residential real estate. Each Cityfund owns a diversified and city-specific portfolio of Nada’s Homeshares, allowing investors to own a part of the $20T home equity market for a single city. Cityfunds are available to the public and accessible to all investors, with a minimum investment requirement as low as $100. This innovative investment product provides investors with exposure to the largest asset class in the world – real estate – and offers them a chance to benefit from the appreciation of home equity.

Homeshares: Cashing Out Home Equity

The Problem with Traditional Options

Traditional options for homeowners looking to access their home equity, such as selling the home or taking on additional debt, come with their challenges. Selling the home and moving out disrupts a homeowner’s life and may not be feasible or desirable in many cases. Taking on additional debt through refinancing or home equity loans can be burdensome, with monthly payments and potential risk. These options do not provide homeowners with a way to access their home equity without significant drawbacks.

How Homeshares Work

Nada’s Homeshares product offers homeowners a way to cash out their home equity without adding debt or monthly payments. The process is straightforward and transparent. Homeowners apply for Homeshares, and Nada’s in-house mortgage team processes the application and inspects the home. Once approved, homeowners receive their funds, and they can continue to enjoy their home with more money in their pockets. In exchange for the upfront cash, Nada is granted a lien-secured interest in the home’s future value. When the homeowner sells the home or refinances the mortgage within the 10-year agreement, Nada realizes returns from its co-investment.

Benefits for Homeowners

Homeshares offer numerous benefits for homeowners looking to access their home equity. With Homeshares, homeowners can cash out their equity in cash without adding new debt or monthly payments. This provides homeowners with a way to access their wealth while maintaining ownership and stability in their homes. The process is quick and transparent, with funds disbursed in just two weeks. Additionally, homeowners can benefit from the appreciation of their home’s value, as Nada’s co-investment realizes returns when the home is sold or refinanced.

Benefits for Nada

Nada also benefits from Homeshares. By purchasing Homeshares from homeowners, Nada can tap into the equity upside of homes in the nation’s top real estate markets. As the homes appreciate in value, Nada’s co-investment realizes returns. This creates a mutually beneficial relationship where both homeowners and Nada can benefit from the appreciation of home equity.

Cityfunds: Investing in Home Equity

Inspiration from Thematic ETFs

Nada’s Cityfunds product was inspired by the transformation seen in the equities market with thematic ETFs. Thematic ETFs offer targeted exposure to specific sectors or themes, allowing investors to capitalize on specific trends or industries. Nada recognized the opportunity to provide this type of thematic and targeted exposure to the real estate market, specifically the home equity sector.

Owning a Part of the Home Equity Market

Cityfunds allow investors to own a part of the $20T home equity market for a single city. Each Cityfund holds a diversified and city-specific portfolio of Nada’s Homeshares. This investment product provides investors with exposure to the largest asset class in the world – real estate – and allows them to benefit from the appreciation of home equity. Cityfunds are available to the public and accessible to all investors, with a minimum investment requirement as low as $100.

Benefits for Investors

Cityfunds offer several benefits for investors. By investing in Cityfunds, investors can access the $20T home equity market and diversify their investment portfolio with real estate assets. Cityfunds provide a unique opportunity to benefit from the appreciation of home equity without the hassle of directly owning and managing properties. This investment product allows investors to participate in the real estate market with a lower barrier to entry and offers them a chance to capitalize on the potential returns of home equity.

The Cityfunds by Nada App

Release and Availability

The Cityfunds by Nada app was released in October 2022 and is now available to anyone who wants to build their real estate wealth. The app allows users to invest in Cityfunds and access the $20T home equity market. With the app, users can easily track their investments, monitor performance, and stay updated on the latest news and developments in the real estate market. The Cityfunds by Nada app offers a user-friendly and convenient platform for investors to participate in the home equity market.

Success with Homeshares

Since the release of the Homeshares product in late August 2022, Nada has helped over 70 homeowners unlock $3M in home equity. Nada’s approach has proven successful, with low customer acquisition costs of approximately $500 per homeowner. The Homeshares product has provided homeowners with an accessible and efficient way to cash out their home equity while maintaining ownership and stability in their homes.

Revenue Potential

Nada’s vertically-integrated business model enables them to generate revenue through multiple services. By sourcing, originating, managing, and disposing of real estate assets, Nada can generate a high-growth revenue model while keeping fees and costs low for Cityfunds investors. Nada has consistently generated over $1M in revenue since 2021 and expects to continue experiencing growth and success with their innovative wealthtech platform.

Nada’s Business Model

Revenue Generation

Nada’s business model revolves around generating revenue through multiple services related to the home equity market. By offering Homeshares and Cityfunds, Nada can tap into the $20T home equity market and provide homeowners and investors with innovative solutions. Nada earns a gross profit of over $40 per $100 invested in a Cityfund by year 5, indicating the potential for significant revenue generation. This vertically-integrated business model allows Nada to control the entire process from sourcing to disposition, creating a streamlined and efficient revenue-generation model.

Value for Investors

Nada’s business model also focuses on providing value for investors. By offering accessible and innovative investment products, Nada allows investors to participate in the $20T home equity market and benefit from the appreciation of home equity. Additionally, Nada’s vertically-integrated approach helps keep fees and costs low for Cityfunds investors, creating a mutually beneficial relationship where both Nada and investors can thrive.

Conclusion

Nada, a wealthtech platform, is revolutionizing the home equity market by unlocking $20T of trapped wealth for homeowners and creating opportunities for real estate investors. Through their innovative Homeshares and Cityfunds products, Nada provides homeowners with a way to cash out their home equity without adding new debt or monthly payments. Simultaneously, Nada offers investors the chance to tap into the $20T home equity market and benefit from the appreciation of home equity. With the release of the Cityfunds by Nada app, investors can easily access and track their investments in the home equity market. Nada’s vertically-integrated business model ensures revenue generation and value for both homeowners and investors. By the leveraging the power of technology and the home equity market, Nada is creating a level playing field and unlocking opportunities for financial stability and growth.

References

- Nada, A Wealthtech Platform, Is Focused On Unlocking $20T Home Equity Market For Homeowners And Investors | Crowdfund Insider