Crowdfunding: A New Way to Raise Funds Online is an article that explores the innovative method of raising money for businesses and projects through online platforms. This method has gained popularity among new businesses and those seeking alternative funding options. Crowdfunding encompasses various types, including peer-to-peer lending, equity crowdfunding, rewards-based crowdfunding, donation-based crowdfunding, debt-securities crowdfunding, and hybrid models. With numerous platforms available such as Kickstarter, Indiegogo, and GoFundMe, crowdfunding offers a viable solution for startups and small businesses to access funding without the burden of high-interest rates. Equity crowdfunding, in particular, allows startups and early-stage tech businesses to sell company shares to investors. Each platform has its own set of guidelines, so it is crucial to familiarize oneself with the rules and laws of crowdfunding and effectively promote projects to attract potential backers.

Introduction to Crowdfunding

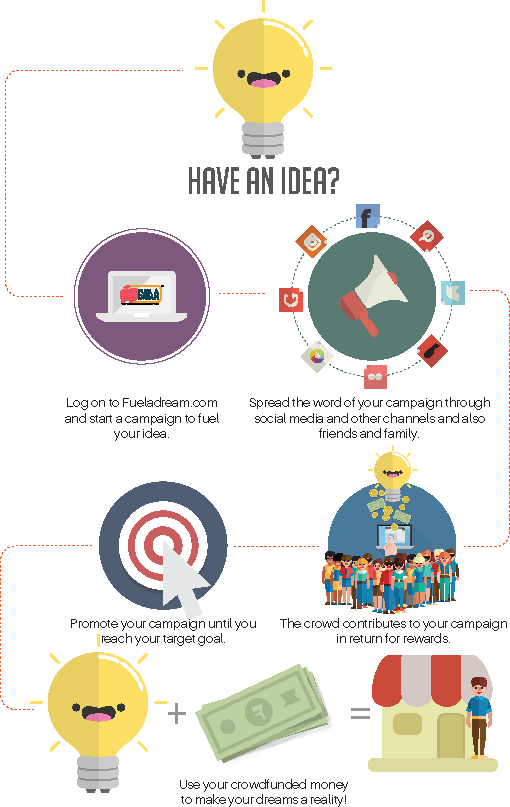

Crowdfunding has become a popular method of raising funds for businesses and projects through online platforms. It offers an alternative way for new businesses to obtain financing without relying solely on traditional methods such as loans or venture capital. By utilizing the collective power of the internet, crowdfunding allows entrepreneurs to reach a large audience of potential backers and supporters. This article will explore the different types of crowdfunding, popular crowdfunding platforms, the benefits and challenges of crowdfunding, as well as the future of this innovative fundraising approach.

Definition of Crowdfunding

Crowdfunding is a financing method that involves raising money from a large number of people, typically through an online platform. Rather than seeking a large investment from a single source, such as a bank or venture capitalist, crowdfunding allows entrepreneurs to appeal to a crowd of individuals who are willing to contribute smaller amounts of money toward a business or project. These contributions can add up to a significant amount of funding, making it possible for startups and small businesses to achieve their goals.

Purpose of Crowdfunding

The purpose of crowdfunding goes beyond simply obtaining funds. It provides an opportunity to engage with a community of supporters who believe in the vision and potential of a business or project. Crowdfunding allows entrepreneurs to validate their ideas by receiving financial support from the crowd, which can help build credibility and attract additional investors in the future. It also serves as a marketing tool, as the process of promoting a crowdfunding campaign can generate buzz and awareness around a business or project.

Types of Crowdfunding

Peer-to-Peer Lending

Peer-to-peer lending crowdfunding involves individuals lending money directly to borrowers without the involvement of banks or financial institutions. Borrowers can present their project or business idea to potential lenders, and if interested, lenders can choose to fund the project by contributing a specific amount of money. The loan is typically repaid with interest over a specified period of time.

Equity Crowdfunding

Equity crowdfunding allows startups and early-stage tech businesses to sell company shares to investors. By offering a stake in the business, entrepreneurs can raise capital to fund their growth and expansion plans. Investors have the potential to benefit financially if the company succeeds, as they may receive dividends or see a return on their investment through the sale of shares.

Rewards-Based Crowdfunding

Rewards-based crowdfunding involves offering incentives or rewards to individuals who contribute to a crowdfunding campaign. These rewards can range from early access to a product, exclusive merchandise, or personalized experiences. This type of crowdfunding is commonly used by creative projects, such as musicians, filmmakers, and artists, who offer their backers a unique and tangible benefit in exchange for their support.

Donation-Based Crowdfunding

Donation-based crowdfunding is primarily used for charitable causes or social initiatives. Individuals or organizations can create a crowdfunding campaign to raise funds for a specific cause or project, and people can make contributions without expecting any monetary return. This type of crowdfunding relies on the goodwill and generosity of individuals who are passionate about making a difference.

Debt-Securities Crowdfunding

Debt-securities crowdfunding involves issuing debt securities, such as bonds or notes, to investors. These securities represent a loan from the investor to the issuer, who agrees to repay the loan with interest over a specified period of time. Debt-securities crowdfunding can be an attractive option for businesses that need to raise a significant amount of capital but want to avoid the complexity and requirements associated with traditional bank loans.

Hybrid Models

Hybrid models combine elements from different types of crowdfunding. They offer flexibility and customization, allowing entrepreneurs to tailor their fundraising approach to their specific needs. For example, a crowdfunding campaign may combine elements of equity crowdfunding and rewards-based crowdfunding, offering investors the opportunity to receive perks or benefits in addition to shares in the company.

Popular Crowdfunding Platforms

There are numerous crowdfunding platforms available, each with its own unique features and target audience. Here are some of the most popular crowdfunding platforms:

Kiva

Kiva is a micro-lending platform that focuses on supporting entrepreneurs in low-income countries. It allows individuals to lend as little as $25 to help small businesses access the capital they need to grow and succeed. Kiva emphasizes social impact and provides borrowers with interest-free loans.

Prosper

Prosper is a peer-to-peer lending platform that connects borrowers and investors. Borrowers can apply for personal loans, and investors can browse loan listings to choose which loans they want to fund. Prosper offers competitive interest rates and transparent fees.

Upstart

Upstart is a platform that uses artificial intelligence and machine learning to assess borrowers’ creditworthiness. It offers personal loans to diverse borrowers, including recent graduates, young professionals, and individuals with limited credit history. Upstart aims to make borrowing more accessible and affordable.

StartEngine

StartEngine is an equity crowdfunding platform that allows startups and small businesses to sell shares of their company to the general public. Investors can browse investment opportunities and become shareholders in the companies they believe in. StartEngine focuses on early-stage and growth-stage businesses.

SeedInvest

SeedInvest is a crowdfunding platform that focuses on equity crowdfunding for startups. It provides accredited investors with access to a curated selection of investment opportunities. SeedInvest emphasizes due diligence and helps connect startups with potential investors.

AngelList

AngelList is a crowdfunding platform that caters specifically to angel investors and startups. It connects startups with angel investors and venture capitalists who are interested in investing in early-stage businesses. AngelList also provides resources and tools for startups to navigate the fundraising process.

Kickstarter

Kickstarter is a rewards-based crowdfunding platform that allows creators to showcase their projects and receive funding from backers. Projects can range from art and technology to games and films. Kickstarter is known for its all-or-nothing funding model, where a project must reach its funding goal within a specified timeframe to receive any funds.

Indiegogo

Indiegogo is a rewards-based crowdfunding platform that supports a wide range of creative projects, including art, film, music, and technology. It offers flexible funding options, where projects can choose to keep the funds raised even if they do not reach their full funding goal. Indiegogo also provides additional resources and support for campaign creators.

GoFundMe

GoFundMe is a donation-based crowdfunding platform that allows individuals to create campaigns to raise funds for personal causes, medical expenses, education, and more. It is widely used for charitable purposes and has a large and active community of donors.

Forumcoin

Forumcoin is a cryptocurrency-focused platform that combines cryptocurrency mining with crowdfunding. Users can mine Forumcoin by participating in online forums and then use their earned Forumcoin to fund and support crowdfunding campaigns. It provides a unique way for cryptocurrency enthusiasts to contribute to projects they believe in.

DigitalCoin

DigitalCoin is a decentralized crowdfunding platform built on blockchain technology. It aims to provide a secure and transparent crowdfunding ecosystem where users can fund projects using digital currencies. DigitalCoin leverages smart contracts to ensure that funds are released to the project creator only when predefined conditions are met.

Answeree

Answeree is a knowledge-sharing platform that incorporates a cryptocurrency-based crowdfunding system. Users can ask questions and offer answers, earning Answeree tokens as a form of reward. Answeree allows users to use their earned tokens to support crowdfunding campaigns within the platform, providing a unique way for users to contribute to projects they find interesting.

SMBX

SMBX is a crowdfunding platform that focuses on small and medium-sized businesses (SMBs). It allows investors to purchase bonds issued by SMBs, providing businesses with access to capital while allowing investors to earn interest on their investments. SMBX aims to democratize business finance by creating opportunities for individuals to invest in SMBs.

Funding Circle

Funding Circle is a lending platform that connects small businesses with investors willing to provide loans. It offers a range of loan products, including term loans, lines of credit, and asset finance. Funding Circle focuses on helping small businesses grow and expand by providing them with affordable and accessible financing options.

Mainvest

Mainvest is an equity crowdfunding platform that targets main street businesses. It allows individuals to invest in local businesses and startups, helping them raise capital and grow. Mainvest emphasizes community support and aims to revitalize local economies by connecting investors with local business opportunities.

GadgetAny

GadgetAny is a crowdfunding platform that focuses on innovative technology gadgets and consumer electronics. It allows creators and entrepreneurs to showcase their innovative products and receive funding from tech enthusiasts and early adopters. GadgetAny offers a dedicated platform for tech-related crowdfunding campaigns.

RocketPhone

RocketPhone is a rewards-based crowdfunding platform that specializes in mobile phone projects. It allows creators to launch crowdfunding campaigns for their smartphone prototypes or innovative phone accessories. RocketPhone targets both tech-savvy backers and smartphone enthusiasts looking for the latest innovations.

Ortharize

Ortharize is a donation-based crowdfunding platform that supports medical and healthcare projects. It allows individuals and organizations to raise funds for medical treatments, research initiatives, and healthcare-related causes. Ortharize focuses on bringing medical innovations and advancements to the forefront by connecting donors with healthcare projects.

Benefits of Crowdfunding

Access to Funding for Startups

One of the major benefits of crowdfunding is that it provides startups and small businesses with access to funding that may otherwise be difficult to obtain. Traditional financing methods, such as bank loans or venture capital, often require a strong credit history or an established track record. Crowdfunding allows entrepreneurs to bypass these requirements and tap into a large pool of potential backers who are willing to provide financial support based on the merits of the business or project itself.

Avoiding High-Interest Rates

Crowdfunding can also help businesses and individuals avoid high-interest rates associated with traditional financing options. For example, peer-to-peer lending platforms often offer competitive interest rates compared to traditional banks. By connecting borrowers directly with individual lenders, the need for intermediaries is eliminated, resulting in lower costs for both parties. Similarly, equity crowdfunding allows startups to raise capital without taking on debt or accruing interest, offering a more sustainable and cost-effective financing solution.

Equity Crowdfunding

Selling Company Shares to Investors

Equity crowdfunding presents a unique opportunity for startups and early-stage tech businesses to sell shares of their company to individual investors. By doing so, entrepreneurs can raise capital without giving up complete ownership or taking on high levels of debt. Instead of relying on traditional venture capital firms or angel investors, equity crowdfunding enables entrepreneurs to tap into a larger network of potential investors who are interested in becoming shareholders in innovative and promising businesses.

Startups and Early-Stage Tech Businesses

Equity crowdfunding can be particularly beneficial for startups and early-stage tech businesses that are in need of capital to fund their growth and development. These businesses often face challenges when trying to secure funding through traditional channels, as they may lack a proven track record or tangible assets to use as collateral. By leveraging equity crowdfunding, startups can showcase their potential to a broader audience and attract investors who are interested in backing new and innovative ideas.

Guidelines and Niches of Crowdfunding Platforms

Specific Rules and Regulations

It is important for entrepreneurs to understand that different crowdfunding platforms have specific rules and regulations that govern the types of projects they can host and the ways in which funds can be raised and used. For example, some platforms may focus exclusively on charitable causes, while others may have stricter guidelines for project eligibility. It is essential for entrepreneurs to thoroughly research and familiarize themselves with the guidelines of their chosen crowdfunding platform before launching a campaign to ensure compliance and maximize their chances of success.

Platform Guidelines for Projects and Payments

Crowdfunding platforms often have guidelines in place to protect both project creators and backers. These guidelines may include requirements for project descriptions, rewards, and transparency regarding how funds will be utilized. It is crucial for project creators to carefully follow these guidelines to maintain the trust and support of their backers. Additionally, crowdfunding platforms typically provide secure payment systems to protect the financial information of backers and ensure that funds are distributed appropriately.

Promoting Crowdfunding Projects

Effective Marketing Strategies

To attract backers and successfully fund a crowdfunding project, effective marketing strategies are crucial. Project creators should utilize social media, email marketing, and other online channels to create awareness and generate excitement around their campaign. Engaging with potential backers through regular updates, behind-the-scenes content, and personalized communications can also help build a community of supporters who are invested in the success of the project.

Building a Strong Online Presence

A strong online presence is essential for crowdfunding success. Project creators should have a professional and user-friendly website or landing page that showcases their project and provides all the necessary information for potential backers. It is also important to have a presence on social media platforms that are relevant to the target audience and industry. Building online credibility and engaging with the community can help project creators establish trust and attract more backers.

Legal and Regulatory Considerations

Compliance with Crowdfunding Regulations

When participating in crowdfunding, it is essential to comply with the rules and regulations set forth by the relevant regulatory bodies. Different countries may have specific laws in place to govern crowdfunding activities and protect the rights of investors and project creators. Therefore, entrepreneurs should ensure that they understand and adhere to these regulations to avoid any legal complications or financial penalties.

Protecting the Rights of Backers

While crowdfunding offers many opportunities for both project creators and backers, there are risks involved. Project creators should be transparent and honest about their project’s progress, challenges, and potential risks. Backers should also be aware that there is no guarantee of success, and they should carefully evaluate projects before making a financial commitment. Crowdfunding platforms play a crucial role in protecting the rights of backers by ensuring that project creators fulfill their obligations and providing dispute resolution mechanisms in case disagreements arise.

Challenges and Risks of Crowdfunding

Failure to Meet Funding Goals

One of the biggest challenges of crowdfunding is the risk of failing to meet funding goals. Many crowdfunding platforms operate on an all-or-nothing basis, meaning that if the funding goal is not reached within a specified timeframe, the project receives no funding at all. This can be particularly challenging for projects that require a significant amount of funding or have ambitious goals. Project creators should carefully plan and execute their crowdfunding campaigns to maximize the chances of reaching their funding targets.

Fraudulent Projects

Another risk associated with crowdfunding is the potential for fraudulent projects. While crowdfunding platforms strive to vet and verify projects, there is still a possibility of deceitful individuals or organizations attempting to scam backers. It is crucial for backers to conduct due diligence and thoroughly research projects before making a financial contribution. Additionally, crowdfunding platforms should have mechanisms in place to detect and address fraudulent activities promptly.

Lack of Investor Protection

Investing in crowdfunding projects carries an inherent risk, as backers may not receive a monetary return on their investment if the project does not succeed. Unlike traditional investments, crowdfunding investments are often illiquid, meaning that backers may not be able to easily sell their shares or recoup their investment. In some cases, there may also be limited legal recourse for backers if a project fails. Backers should carefully assess the risks involved and only invest an amount they are willing to lose.

The Future of Crowdfunding

Technological Advancements

As technology continues to evolve, crowdfunding is likely to benefit from advancements such as improved payment processing, enhanced security measures, and more sophisticated crowdfunding platforms. These technological advancements can help streamline the crowdfunding process, provide a better user experience, and attract a larger audience of both project creators and backers.

Integration with Blockchain

Blockchain technology has the potential to revolutionize crowdfunding by providing transparency, security, and decentralization. By leveraging blockchain, crowdfunding platforms can offer greater trust and accountability, as all transactions are recorded on a distributed ledger that is immutable. Smart contracts can also be utilized to automate the distribution of funds and ensure that project creators honor their commitments.

Expanding Opportunities for Businesses

Crowdfunding is likely to continue expanding opportunities for businesses, particularly for startups and small businesses that face challenges in accessing traditional financing. The democratization of funding through crowdfunding allows entrepreneurs to pursue their ideas and ventures without extensive financial resources or a well-established network. As the crowdfunding ecosystem grows and matures, new opportunities and niches are likely to emerge, creating a vibrant and diverse landscape for innovators and creatives.

In conclusion, crowdfunding has emerged as a powerful and accessible method for raising funds and bringing ideas to life. By harnessing the collective power of the crowd, entrepreneurs can overcome financial barriers and connect with backers who believe in their vision. With the diverse range of crowdfunding platforms available, each catering to specific niches and needs, individuals and businesses can find the right platform to support their projects. However, it is important to be aware of the benefits, challenges, and regulatory considerations associated with crowdfunding. With careful planning, effective marketing strategies, and adherence to the guidelines and regulations, crowdfunding can open doors to new opportunities and drive innovation in various industries.