What is Equity Crowdfunding?

Equity crowdfunding is a financing strategy where investors are given ownership in a company in exchange for capital. It provides an alternative to traditional forms of raising capital and gives entrepreneurs more flexibility in choosing their investors. Instead of relying solely on banks or venture capitalists, startups can turn to the general public to secure the funding they need to launch or grow their business.

There are different types of equity crowdfunding, but the basic concept involves issuing securities to the public in exchange for investment. Securities may include shares of stock, membership interests in a limited liability company, or convertible debt. By offering these securities, startups are able to attract a wider pool of potential investors and tap into a larger source of capital.

Types of Equity Crowdfunding

Offering securities to the public

One type of equity crowdfunding involves offering securities directly to the public. This means that anyone, regardless of their income or net worth, can invest in the startup. This is in contrast to traditional securities offerings, which are often limited to accredited investors who meet certain income or net worth thresholds.

By offering securities to the public, startups have the opportunity to raise funds from a wide range of individuals who may be interested in supporting their business. This approach democratizes investing and allows everyday people to become stakeholders in promising startups.

Equity crowdfunding regulations

Equity crowdfunding is subject to regulations to protect both investors and entrepreneurs. In the United States, for example, the Securities and Exchange Commission (SEC) has established rules under the JOBS Act that govern equity crowdfunding campaigns. These regulations include limits on the amount of money that can be raised, disclosure requirements, and ongoing reporting obligations.

Entrepreneurs must navigate these regulations and ensure compliance when launching an equity crowdfunding campaign. Working with legal professionals who specialize in securities law can help startups understand their obligations and navigate the regulatory landscape.

Rewards-based crowdfunding vs equity crowdfunding

It’s important to note that equity crowdfunding is different from rewards-based crowdfunding. In rewards-based crowdfunding, contributors receive a tangible reward or product in exchange for their financial support. This could be a discount on a future purchase, a limited-edition item, or early access to a product.

Equity crowdfunding, on the other hand, involves offering securities and ownership in the company. Contributors become investors and have a financial stake in the success of the startup. While rewards-based crowdfunding can be a valuable tool for launching a product or project, equity crowdfunding offers the potential for long-term financial returns.

/https://assets.iprofesional.com/assets/jpg/2019/01/472311.jpg)

Benefits of Equity Crowdfunding

Equity crowdfunding offers several benefits for both entrepreneurs and investors. Understanding these benefits can help startup founders decide if equity crowdfunding is the right financing strategy for their business.

Flexibility in choosing investors

One of the key benefits of equity crowdfunding is the flexibility it provides in choosing investors. Startups can tailor their crowdfunding campaigns to attract investors who align with their vision and values. This could include individuals who are passionate about the industry or have relevant expertise that can contribute to the success of the business.

By being able to choose their investors, startups can build a community of supporters who are not only financially invested but also emotionally engaged with the company. This can lead to valuable partnerships, mentorship opportunities, and a strong network of advocates for the startup.

Access to a wider pool of investors

Equity crowdfunding opens up the opportunity to attract a wider pool of investors compared to traditional funding methods. Instead of relying on a small group of venture capitalists or angel investors, startups can tap into a larger network of potential backers.

The general public now has the opportunity to invest in startups they are interested in and believe in. This means that entrepreneurs can access capital from individuals who may not have been traditionally involved in the investment process. This diversification of investors can bring fresh perspectives, ideas, and resources to startups.

Opportunity to raise more funds

Equity crowdfunding has the potential to help startups raise more funds compared to other financing options. By offering ownership in the company, startups can attract larger investments from a wider range of investors. This can lead to a significant increase in the amount of capital raised.

The ability to raise more funds is particularly beneficial for startups that have ambitious growth plans or need substantial capital to bring their products or services to market. Equity crowdfunding allows these startups to access the capital they need to realize their vision and achieve their business goals.

Greater exposure for the startup

Launching an equity crowdfunding campaign can also provide startups with greater exposure and visibility. The crowdfunding platform itself can act as a marketing tool, attracting attention and interest from potential investors, media outlets, and industry influencers.

Successful equity crowdfunding campaigns often generate buzz and attract media coverage. This increased exposure can lead to new opportunities, partnerships, and customer growth. It also serves to validate the startup and its business model, which can be valuable when seeking future funding or partnerships.

Considerations for Entrepreneurs

While equity crowdfunding offers numerous benefits, there are also important considerations that entrepreneurs should take into account before deciding to pursue this financing strategy.

Assessing the suitability of equity crowdfunding

Not every company will benefit from equity crowdfunding, so entrepreneurs should carefully assess the suitability of this approach for their business. Factors to consider include the stage of the business, the industry it operates in, and the target market for the product or service.

Equity crowdfunding may be particularly attractive for startups with a strong brand or a product that has mass appeal. It can also be a good option for businesses that require a relatively modest amount of capital and can offer an attractive return on investment.

On the other hand, startups in highly regulated industries or those with long development cycles may face challenges in attracting investors through equity crowdfunding. It’s important to conduct proper due diligence and market analysis to ensure that equity crowdfunding is a viable option.

Pros and cons of equity crowdfunding

Like any financing strategy, equity crowdfunding has its pros and cons. It’s important for entrepreneurs to weigh these factors and consider how they align with the goals and values of their business.

The pros of equity crowdfunding include providing investors with incentives and quick access to capital. By offering ownership in the company, startups can tap into a larger pool of potential investors and build a community of supporters. Equity crowdfunding also allows entrepreneurs to retain control over their business and make decisions without interference from a single large investor.

However, there are also cons to consider. One of the major drawbacks is the high rate of failure associated with startups. Equity crowdfunding campaigns may not reach their funding goals, leaving the startup without the capital it needs to proceed. Additionally, bringing in new stakeholders through equity crowdfunding can introduce challenges in terms of decision-making, communication, and potential conflicts of interest.

Impact on ownership and decision-making

Equity crowdfunding involves offering ownership in the company to investors. This means that entrepreneurs will be sharing ownership and decision-making power with a larger group of individuals.

While this can provide valuable resources and expertise, it can also lead to challenges. Startups may face increased scrutiny and accountability from investors, who may have different opinions and expectations for the company. This can result in conflicts and the need for effective communication and management strategies.

Entrepreneurs should carefully consider how giving up a portion of ownership will impact their ability to make decisions and shape the direction of their business. It’s important to establish clear expectations and boundaries with investors and to have mechanisms in place for decision-making and conflict resolution.

Potential issues with bringing in new stakeholders

Equity crowdfunding brings in a diverse group of stakeholders who may have different motivations, expectations, and levels of involvement with the startup. While this diversity can be beneficial, it can also introduce potential issues and challenges.

For example, startups may need to navigate the complexities of having a large number of small investors, each with their own opinions and demands. This can create difficulties in managing communication and engagement with investors.

Additionally, equity crowdfunding may result in a fragmented ownership structure, with many individual investors holding small stakes in the company. This can make it challenging to make decisions, particularly if unanimous consent is required for certain actions.

Startups should consider these potential issues and develop strategies for effectively managing relationships with their equity crowdfunding backers. Clear communication, regular updates, and transparency can help maintain positive relationships and mitigate potential conflicts.

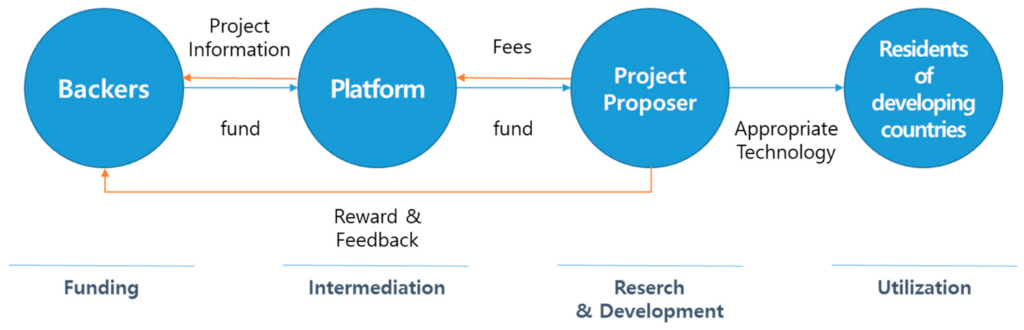

This image is property of www.mdpi.com.

The Process of Equity Crowdfunding

Equity crowdfunding involves several steps and processes that entrepreneurs must navigate. Understanding the process can help startups effectively plan and execute their crowdfunding campaigns.

Finding the right crowdfunding platform

The first step in the equity crowdfunding process is finding the right crowdfunding platform. There are numerous online platforms that specialize in equity crowdfunding and offer different features and services.

Startups should carefully evaluate their options and choose a platform that aligns with their goals and target audience. Factors to consider include the platform’s reputation, track record, fees, and the types of businesses and investors it attracts. It can also be helpful to speak with other entrepreneurs who have used the platform to gauge their experiences.

Preparing the equity crowdfunding campaign

Once a platform has been chosen, startups need to prepare their equity crowdfunding campaign. This involves creating a compelling pitch that highlights the unique value proposition of the business, the market opportunity, and the team behind the startup.

Startups should also establish clear financial and growth projections, as well as a well-defined use of funds. This provides potential investors with a clear understanding of how their capital will be utilized and the potential returns they can expect.

In addition, startups should ensure that all legal and regulatory requirements are met. This may include preparing the necessary disclosure documents, financial statements, and other relevant information.

Marketing and promotion strategies

Once the campaign is live on the crowdfunding platform, startups need to focus on marketing and promotion to attract potential investors. This may include leveraging social media, email marketing, and content creation to generate awareness and engagement.

Startups should also reach out to their existing network of contacts, including friends, family, and professional connections, to encourage support and investment in the campaign. Engaging with the media and industry influencers can also help generate buzz and attract attention to the crowdfunding campaign.

Collecting and managing investments

As investments start coming in, startups need to have systems in place to collect and manage the funds. This may involve working with a payment processing provider or utilizing the services provided by the crowdfunding platform.

It’s important to ensure that all necessary legal and regulatory requirements are met when collecting and managing investments. Startups should also have processes in place to track and record investor information, issue securities, and provide regular updates to investors.

Legal and regulatory compliance

Throughout the equity crowdfunding process, startups must prioritize legal and regulatory compliance. This includes understanding and complying with the regulations set forth by the relevant governing bodies, such as the SEC in the United States.

Working with legal professionals who specialize in securities law can help startups navigate the complex regulatory landscape and ensure that all requirements are met. This can help mitigate the risk of legal and regulatory issues down the line.

Success Stories of Equity Crowdfunding

Equity crowdfunding has proven to be a successful strategy for many startups. There are numerous examples of companies that have raised significant funds and achieved notable success through equity crowdfunding campaigns.

Notable examples of successful equity crowdfunding campaigns

One notable example of a successful equity crowdfunding campaign is that of Oculus VR, a virtual reality startup. In 2012, Oculus VR launched a campaign on the crowdfunding platform Kickstarter, aiming to raise $250,000 to develop their virtual reality headset, the Oculus Rift.

The campaign surpassed their funding goal and raised over $2.4 million from more than 9,500 backers. This initial success helped attract further investment, including a $75 million funding round led by venture capital firm Andreessen Horowitz. Oculus VR was ultimately acquired by Facebook for $2 billion in 2014, demonstrating the potential for significant returns from equity crowdfunding campaigns.

Positive outcomes for both startups and investors

Equity crowdfunding has not only benefited startups but also provided opportunities for investors to participate in the success of high-growth ventures. By investing in promising startups through equity crowdfunding, individuals have the potential to earn significant financial returns if the company succeeds.

Investing in startups through equity crowdfunding can also provide investors with access to early-stage companies and innovative technologies that may not be available through traditional investment channels. This can be particularly appealing to individuals who are interested in supporting entrepreneurship and being part of the next big innovation.

Lessons learned from successful campaigns

Successful equity crowdfunding campaigns offer valuable lessons for entrepreneurs looking to launch their own campaigns. Some key takeaways include:

- Clearly communicate the value proposition and potential returns to potential investors.

- Leverage the power of social media and online marketing to generate awareness and engagement.

- Engage with the media and industry influencers to amplify the reach of the campaign.

- Offer attractive incentives or rewards to investors to encourage participation.

- Provide regular updates and engage with supporters throughout the campaign to maintain momentum.

By studying successful equity crowdfunding campaigns, entrepreneurs can gain insights and best practices that can increase their chances of success.

Challenges and Risks of Equity Crowdfunding

While equity crowdfunding offers numerous benefits, it also comes with its fair share of challenges and risks. Entrepreneurs should be aware of these potential pitfalls and take steps to mitigate them.

High rate of failure

One of the major risks of equity crowdfunding is the high rate of failure associated with startup businesses. According to some estimates, as many as 90% of startups fail. This means that the majority of equity crowdfunding campaigns may not achieve the desired funding goals or lead to successful businesses.

Investors should be aware of these risks and conduct proper due diligence before investing in a startup through equity crowdfunding. Startups, on the other hand, should be transparent about the risks and challenges they face and provide potential investors with as much information as possible to make an informed investment decision.

Limited control and influence for investors

Investors who participate in equity crowdfunding campaigns generally have limited control and influence over the operations and decision-making processes of the startup. While they may have a financial stake in the company, they may not have a significant say in how the business is run.

This limited control can be a challenge for investors who prefer to have a more active role in the companies they invest in. It’s important for investors to understand and be comfortable with this limitation before participating in an equity crowdfunding campaign.

Lack of liquidity for investments

Investments made through equity crowdfunding are generally illiquid, meaning that it can be difficult to sell or transfer the securities. Unlike publicly traded stocks, which can be easily bought or sold on the stock market, investments made through equity crowdfunding often have limited or no secondary market.

Investors should be prepared for the possibility that they may not be able to easily access their investment for an extended period of time. This can be particularly challenging for individuals who may need liquidity or have a shorter investment horizon.

Legal and regulatory risks

Equity crowdfunding is subject to legal and regulatory requirements that startups and investors must comply with. Failing to meet these requirements can result in legal and financial consequences.

Startups should ensure that they have a thorough understanding of the regulations that apply to equity crowdfunding in their jurisdiction. Working with legal professionals who specialize in securities law can help mitigate the risk of non-compliance.

Similarly, investors should be aware of the legal and regulatory requirements associated with investing through equity crowdfunding. This includes understanding the potential risks and limitations associated with investing in early-stage startups.

Transitioning from Equity Crowdfunding

Equity crowdfunding can be a valuable strategy for startups in the early stages of growth. However, as the company evolves and matures, there may come a time when it makes sense to transition to other forms of financing.

Moving on to institutional funding

As a startup proves its viability and demonstrates significant growth potential, it may become an attractive investment opportunity for institutional investors. Institutional funding, such as venture capital or private equity, can provide startups with larger amounts of capital to fuel further growth.

Transitioning from equity crowdfunding to institutional funding can be a strategic move for startups looking to scale rapidly. However, it’s important for entrepreneurs to carefully evaluate the terms of these investments and consider how they align with the long-term goals and vision of the company.

Attracting angel investors

Angel investors can also be a valuable source of funding for startups as they transition from equity crowdfunding. Angel investors are typically experienced entrepreneurs or high-net-worth individuals who invest their own capital into early-stage companies in exchange for ownership stakes.

Attracting angel investors requires building relationships and networking within the startup ecosystem. Entrepreneurial networks, industry events, and incubators or accelerators can provide startups with opportunities to connect with angel investors.

Implications for future financing rounds

For startups that have raised funds through equity crowdfunding, it’s important to consider the implications for future financing rounds. Investors in subsequent funding rounds may require startups to have a clear plan for managing and/or buying out equity crowdfunding investors.

Startups should also consider the impact that equity crowdfunding may have on their valuation, as well as the potential dilution of ownership that may occur with each subsequent funding round. Balancing the needs of existing and future investors can be a complex process that requires careful planning and consideration.

Maintaining relationships with equity crowdfunding backers

Equity crowdfunding backers can be valuable advocates, supporters, and customers for startups. Even as a company transitions to other forms of financing, it’s important to maintain positive relationships with these early supporters.

Regular communication, updates, and exclusive access to new products or services can help foster long-term relationships and cultivate a loyal community of backers. These relationships can continue to be a valuable asset for startups in terms of word-of-mouth marketing, user feedback, and ongoing support.

Role of Crowdfunding Platforms

Online crowdfunding platforms play a crucial role in facilitating the equity crowdfunding process. These platforms provide a framework for startups to launch and manage their crowdfunding campaigns, as well as connect with potential investors.

Features and services offered by online crowdfunding platforms

Crowdfunding platforms offer a range of features and services that support startups throughout the equity crowdfunding process. These may include customizable campaign pages, secure payment processing, investor management tools, and reporting and analytics features.

Some platforms also provide additional services such as marketing support, legal and regulatory guidance, and access to investor networks. These services can help startups maximize the success of their crowdfunding campaigns and navigate the complexities of the equity crowdfunding landscape.

Marketplace for connecting entrepreneurs and investors

Crowdfunding platforms act as marketplaces, connecting entrepreneurs and investors. They provide a centralized platform where startups can showcase their business and investors can discover and invest in promising opportunities.

By aggregating a community of entrepreneurs and investors, crowdfunding platforms create a dynamic ecosystem that fosters collaboration, innovation, and economic growth. This marketplace approach opens up opportunities for businesses and individuals who may have otherwise been excluded from traditional financing channels.

Facilitating the investment process

Crowdfunding platforms streamline the investment process, making it easier and more accessible for individuals to invest in startups. They provide secure payment processing and investor management tools that simplify the investment process for both entrepreneurs and investors.

This simplification of the investment process helps to reduce barriers to entry and democratize investing. Individuals who may not have had previous experience or access to traditional investment opportunities can participate in the equity crowdfunding process and support businesses they believe in.

Additional support and resources for startups

In addition to facilitating the investment process, crowdfunding platforms often offer additional support and resources for startups. This may include educational materials, best practices guides, and access to a community of entrepreneurs who have successfully navigated the equity crowdfunding process.

Startups can leverage these resources to enhance their crowdfunding campaigns, refine their pitches, and gain insights from experienced entrepreneurs. This additional support can be particularly valuable for first-time entrepreneurs who may be navigating the fundraising process for the first time.

Conclusion

Equity crowdfunding offers a unique and innovative approach to financing startup businesses. By offering ownership in the company to investors, startups can access a wider pool of potential backers and raise more funds compared to traditional financing methods. Equity crowdfunding provides flexibility in choosing investors, access to a wider network of supporters, and the opportunity to raise funds while generating exposure for the startup.

However, equity crowdfunding also presents challenges and risks that entrepreneurs must carefully consider. Startups must assess the suitability of equity crowdfunding for their business, weigh the pros and cons, and be prepared for the impact on ownership and decision-making. The process of equity crowdfunding requires finding the right platform, preparing a comprehensive campaign, marketing and promoting the campaign, collecting and managing investments, and ensuring legal and regulatory compliance.

Success stories demonstrate the potential for significant returns and positive outcomes for both startups and investors. However, the high rate of failure and lack of liquidity for investments highlight the risks associated with equity crowdfunding. Startups may transition from equity crowdfunding to other forms of financing, such as institutional funding or angel investors, as they mature and grow.

Crowdfunding platforms play a pivotal role in facilitating the equity crowdfunding process by providing a framework, connecting entrepreneurs and investors, and offering additional support and resources for startups.

Overall, equity crowdfunding offers a powerful tool for entrepreneurs to access the capital they need to bring their innovative ideas to life. With careful planning, preparation, and execution, equity crowdfunding can provide startups with the financial resources, exposure, and support they need to succeed.